Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands: Micron,Samsung,Hynix, Nanya, Kioxia, MXIC, Winbond,CPU.HDD

Overview: It seems that in a blink of an eye, we have entered the final quarter of 2021. Looking back at the memory market in the first half of the year, almost all of them are out of stock. This is mainly due to the severe global raw material shortage. Major customers have increased their ordering volume to grab market share. However, since the third quarter, the memory market has turned to a downward trend. Some customers have reduced their orders due to over-orders in the early period, and the shortageof other IC chips has delayed the actual demand for memory parts resulting in an imbalance between supply and demand. Hence, the market is showing bearish sign. The traditional Q4 peak season is coming, but PC-side demand is still declining. In the nutshell, the memory market’s condition remains a mystery which needs to be observed closely.

DDR4 After the National Day holiday, the price of DDR4 is relatively stable. In mid-to-late September, some distributors cleared their inventory at very low prices. On the contrary, the prices of some parts after the holiday were a bit higher than the prices before the holiday. The price of Samsung and Hynix DDR4 8Gb remained fluctuating around US$3.85, and the price of DDR4 4Gb remained fluctuating around US$2.50.After the holiday, the storage of upstream channels was not large. It may be that the supplier side and the customer side tend to wait and see. It is expected that the following market may tend to decline more slowly. Micron's DDR4 supply is stable, prices are slowly falling, and inventory depletes slowly. Part of the reason is that large end customers have already prepared enough Q4 demand last month. From the customer’s perspective, next year’s Q1 purchases will make its way into their warehouse in the next couple of months.

DDR3 The price of DDR3 has also been stable recently. Samsung and Hynix have recently had a lot of demand for DDR3 2Gb. The price fell below US $2.10 in September. However, due to excessive demand, the market has limited inventory and the price has risen slightly. It is currently fluctuating around US$2.20; DDR3 4Gb. The price hovers around US$2.40. Some brokers still want to promote the flow of inventory at low prices, and it seems that prices should slow down. As for Nanya, prices have not fluctuated significantly compared with September and 2G DDR3 256x8 is still in short supply. It’s a strange phenomenon that the price of 4Gb DDR3 of other brands has fallen below US$2.50, but Micron is still firm at around US$3.30.The market was once bearish on the price of this part. Unexpectedly, the pricewill rebound again after falling to around US$2.90 in early September. Above US$3.XX, it’s puzzling. I think it’s because the Micron manufacturer didn’t lower the book price.

Nand Flash For Winbond, the demand for Nand Flash is not as good as in the previous few months, the price is slightly lower, and the supply side is sufficient. Any demands you can contact to me. As for Kioxia, large-capacity Nand Flash continues to be out of stock, and prices continue to rise steadily. Small-capacity Nand Flash is relatively sufficient.Customers in need can choose high-quality sources and buy them as soon as possible. For Macronix, customers have weakened their purchases due to the delay of the main control chip, and the manufacturer has successively arrived,and the price has been relatively stable recently. As for Micron, the delivery period for feedback from the source for individual material numbers that are indemand is still relatively long, requiring more than three months. Existing inventory is still slow.

Nor Flash As for Winbond, Nor Flash’s recent transactions have been in a sluggish state. In brokers’ side, recent price support has been relatively good in order to reduce their inventory. For Macronix, due to the delay in the delivery of the main chips required by security and Netcom customers, customers have slowed down the pace of Nor Flash sourcing, but subsequent potential demand still exists, and the pressure from the original factory may increase sharply as the traditional peak seasonarrives. , The lead time of the uncommon parts is still very long. As for Micron, Nor Flash is still out of stock, and small quantities have been arriving recently, but customers will pull the goods immediately after the goods arrival, and the market is still short of stock.

EMMC The price of Samsung EMMC is considered stable recently, and the relative inventory pressure of upstream channels is relatively small. Once there is a large demand for goods in the market, the price may rise slightly. If there is stable demand, some inventory will be prepared at the right time. As for Kioxia, the stable price that lasted for a quarter has gradually become unclear. The sudden shortage of 8GB has left some customers at a loss. Other capacities are temporarily available, but the volume is not very sufficient, customers in need can buy as soon as possible to avoid any market uncertainties. For SanDisk, the volume of consumer-grade EMMC is sufficient, while the volume of industrial-grade EMMC is relatively small, and the price is nonetheless stable.Micron EMMC is still facing a huge shortage, and the market price is constantly rising. The ultra-high price has discouraged some customers and turned to seek alternatives from other brands. At present, the supply of other brands of EMMC is relatively stable, and the price is also at a normal level. Because Micron’s EMMC’s customer base is mainly industrial control, medical, and automotive, it is not easy to substitute, and quite a few customers are forced to accept high prices to meet production needs.

Memory Module The memory module market is still in a state of declining. Upstream channel vendors are still focusing on reducing inventory and lowering prices. The market demand is still very slow. The inventory can only be reduced at a loss. The large-capacity 128GB has alarge amount of spot on the market, so even if the price is lowered, it is difficult to digest. The price of server memory sticks is also falling, the demand side is very weak, and the broker continues to lower the price, but the customers are still unwilling to bid. More attention needs to be paid to the customer's demand status, and the market will get better only when the demand improves.

SSD The solid-state drive market has been in a downturn in Q3, and the months-long upside-down market has been suffering. Recently, since mid-to-late September, the market for enterprise-level SSDs has stabilized, and channel vendors’ quotations have stabilized and increased slightly. In particular, the demand for SATA interface SSD PM883 series has continued to increase and there is a shortage, and themarket brokers’ bids will no longer continue to down. However, the quotations of consumer SSDs still fell slightly, and the upstream end is not willing to reduce prices, and there is little room for decline. In fact, there is not much inventory in the supplier side, but the price is weak due to poor demand, and the price may reverse upward as the demand increases.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

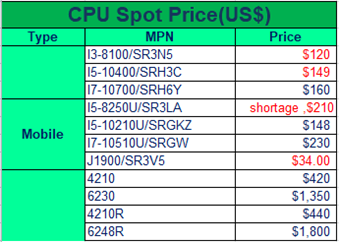

As we move into October, the market is in a chaotic situation, especially for the hot items, also the demand from end customer is lower than before, so market is searching for the right price point. As consumer market slows down, main stream CPU market is quiet.

1.DT: 10, 11 generation parts demand all drop, price keeping drop, Price for i5-10400 is around $140 and one month before is about $145-150. Low end DT CPU shows shortage, just because ofthe tight supply, market have less offer of such parts include ,G3900, G4900, G4900Tetc.

2.Mobile: from the report of Q3’s business number, Laptop market is weak, that makes most of the Mobile CPU model price drop. I7-10510U price now around $226 compared to $237 in previous month. Only I5-8250U, I5-8350U, I7-8550U show demand from IPC customer. 8th generation parts are considered as IOTG parts, not the popular Mobile CPU, as the customer all from IPC industry.

3.IOTG: this is a hot market, demand is good, but supply is really bad, some model price have moved up 4-5 times already, like E3845, used to be a $30 parts, but now market is running at $150+, and other shortage model as E3930, E3940, E3950, E3825, D-1508, D-1519E-2224G etc.. For LAN chip, customer is looking for low cost parts after holiday. It seems that they have some stock on hand and not buying much from open market, that confuses the market. Now I211AT have a reference price that’s easy to go, $5-$6,but for I210AT there is no firm price yet. Other shortage items are I350AM4, X710.Supply is bad and price have increased, now I350AM4 quote is around $125+, andthe price was only $85 2 weeks ago. Chipsets also face tight supply, main model is H110, H470, B460, etc.

Pls take as a reference of below table.

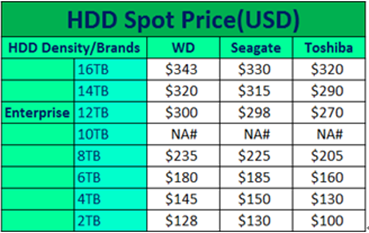

HDD

1.Recently the enterprise HDD is still in shortage. Especially for the 1TB~ 10TB items and we learned that Seagate manufactory limited the shipments from agents, that leads to the small capacity items face huge shortage. For the high capacity items,there are some stocks in the market, and the price of these items are stable.

2.For WD side, there are many shipments of 16TB and18TB, but the supply of small capacity such as 1TB~2TB is still insufficient, however for the 4TB~8TB parts, there are some stocks, but the demand seems not so strong, we can get good price, if you have demand, please contact us.

3.For the SSD parts, WD and Intel SSD still in huge shortage, especially for Intel, the normal series items, such as S4510, S4610, and the capacity of 240GB, 480GB, and 960GB all have no stocks from market. The big OEM customer can get the stocks from Intel directly, but for the middle-small-sized customers, they have no choice but only to search in the open market. If you have any stocks, do offer it to us.

If you want to have business with us, please contact our disty sales:

Mr. Zhang:+86-183 6275 0919

Ms. Yang:+86-180 5109 2629

Ms. Yao:+86-135 1055 9053

If you have enquiries, please send e-mail to RFQ@quiksol.com.cn

If you want to communicate with our professional buyers, please contact

Memory@quiksol.com.cn HDD@quiksol.com.cn CPU@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat