Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands: Micron,Samsung,Hynix, Nanya, Kioxia, MXIC, Winbond,CPU.HDD

Overview: Since September, the memory market has really been two extremes. DRAM prices continue to fall despite TSMC’s announcement on price increase. The manufacturer’s book prices too remained the same leading the industry to believe that prices will continue to fall, causing the spot market to dump inventory for stability.It can be clearly felt that the demand for memory from the factory has been greatly reduced, mainly because the shortage of parts has softened down.However, some materials are still out of stock, such as: Micron EMMC, Nor Flash; Cypress Nor Flash. Based on the current delivery schedule, it can be inferred that this out of stock parts will be in short supply before the end of the year.

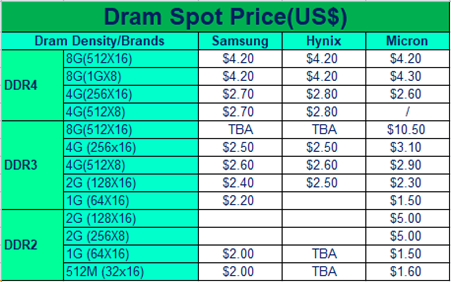

DDR4 All brands of DDR4 products are in sufficient supply and prices have continued to drop recently. Micron 8Gb, 512X16, 1GX8; 4Gb 256X16 have enough stock to support the demand and two new versions of the part number are introduced. Do contact us if there is any demand for - MT40A1G8SA-062E:R, MT40A512M16TB-062E:R, MT40A512M16TB-062E:J – we have strong support for them. The price of Samsung DDR4 8Gb has fallen sharply recently and the market price has fallen below US$4.00. Recently, the supplier had many orders, and the original demand has weakened, so the price has continued to fall. DDR4 4Gb has relatively few orders and the price is relatively stable.

DDR3 DDR3 prices have also continued to decline. What is strange is that Micron’s 4Gb and 2Gb DDR3 prices are still high among these major memory brands. The reason may be that the original manufacturer did not release the price and other brands have lowered their prices to eliminate inventory. Due to the abundant supply of this type of product, the price is not favored by the market. The prices of Samsung and Hynix DDR3 have been stable recently. Because the manufacturer itself does not have much inventory, once the market has demand to find goods, the price will rise slightly. At present, it can be seen that there are not too many stocks in the market and the price should be difficult to drop further. In Nanya, 2G DDR3is still in short supply and the demand on the market has always existed, but the manufacturer's production capacity is obviously unable to meet the market demand.

Nand Flash As for Micron, Nand Flash has an adequate supply and prices are steadily declining. Kioxia, Macronix, and Sky High Memory have had relatively stable prices recently due to low customer demand. However, they have not foreseen the downward adjustment of prices in Q4. Customers in need are advised to buy them as soon as possible. For Winbond,the supply is sufficient, and customers in need are welcome to inquire.

Nor Flash Micron Nor Flash has been out of stock for more than half a year and there is no sign of relief before the end of the year. The prices of some models have been speculated very high. Due to the recent shipment from the factory, customer no longer able to accept high prices. Macronix Nor Flash, a general-purpose model, has very poor recent demand and the market price has gradually fallen, almost the price trough in recent months. However, from the perspective of supply, the delivery and supply in the upcoming Q4 are still not good. As for Winbond, the price of Nor flash has slowed down, but the supply issue remains unsolved. Customers in need are welcome to inquire.

EMMC Micron EMMC is still facing a huge shortage and the market price is also very high. The prices of some parts have even increased more than ten times. It is reported that the shortage of IC controllers has led to tight supply of EMMC. At present, it seems that the shortage of Micron EMMC has no signs of alleviating before the end of the year.The price of Samsung EMMC has been very stable recently. Due to the constant shortage of Controller, Samsung’s manufacturer inventory is limited, and there is no pressure on upstream and market spot inventory. Once there is a large demand for goods, the price may increase slightly. If there is stable demand,appropriate preparations can be made. Some inventory. Kioxia is similar to Samsung in terms of price, and sometimes rebounds.

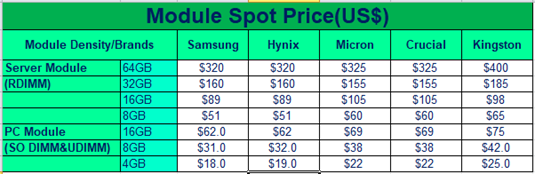

Memory Module Recently, the demand for PC-side memory modules is still poor, and some suppliers are still under inventory pressure. They want to lower prices to clear the inventory. This month, distributors are still focusing on lowering the prices to reduce inventory. The market spot prices continue to decline, due to the recent drop in demand. The market outlook may not have much room for decline and may fluctuate slightly. The transaction of the server-side memory module this month is very unsatisfactory. Most end usershave sufficient stock, and the willingness to buy is not strong. It may require a very advantageous price to motivate customers to buy. The market has slightly lowered the prices this month, and more attention can be paid to the demand of end customers.

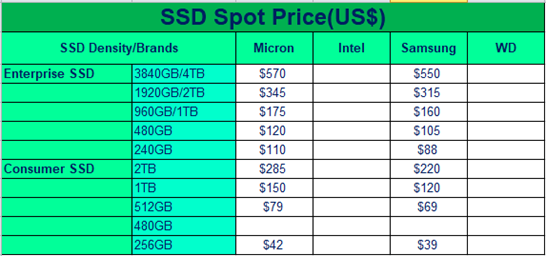

SSD The SSD market is still sluggish recently. Due to the large stocks in the market, and the recent poor demand, there is still a lot of inventory that has not yet been sold. The actual transaction volume is small. At present, the prices of many SSD have fallen to relatively low points, and there may not be much room for decline. According to feedback from upstream channels, Q4 demand will increase, and SSDs may once again face the risk of shortages and price increases, and we need topay more attention to the demand side dynamics.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

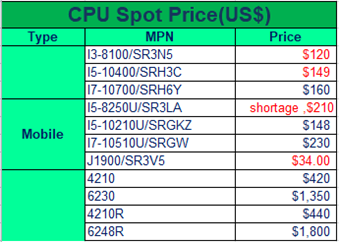

INTEL- most of the mail stream parts is in weak stage - demand is weak and marketprice is dropping. This includes the DT, Mobile, and XEON. So far only IOTG product faces tight supply and have high chance in closing a deal, detail as follow:

1.Notebook: demand remains weak, 10, 11 generation parts all show less or no demand from end customer side. Price keeps dropping, and this is a good PPV business chance. However, real demand must bepresence first before there is any chance to get good cost of parts, including low end MOBILE CPU, N4020, N5000, J4125 etc.

2.DT: price is dropped. I5-10400 price drop to $149 now, and only AMD parts are facing tight supply mainly for DIY or gaming market.

3.Server :4210 demands dropped as well with the price tumbling to around $410. 5220 now is a hot part, there are less offer and price moving up to $1210, for other items it is an opportunity for spot buys.

4.IOTG: Majority of IOTG productsall facing tight supply, and customer show shortage demand, including the E3845,E3930, E3940, etc. and Lan chip. Price from market do have a slight drop, but as the supply situation remained status quo with the normal lead time of 50 weeks, some vendors who have parts on hand hoping to sell at high price. As the demand side weaken, it seems that it is hard to keep the price as it used to be,so it is a good chance for customer to take some stock now. I211AT pricedropped from $7 to $6 or $5.8. I210AT - price have dropped from $22 to $18. There are some chipsets which are gaining upwards momentum - H110, price moving up to$60 (which is very high) and other model price is also showing upwards trend, good source will make good profit at this time.

Pls take as a reference of below table.

HDD

1.Due to the global shortage of chips, the purchasing price of HDD mechanical materials risen a lot. In addition, due to the COVID-19, the demand for notebook and home desktop computers also brought effective support. This also led to HDD manufacturers to increase the prices of HDD for the first time in two years. The whole sale prices for the July -September period rose 5 percent from the previous quarter;

2.In terms of shipment comparisons, we can see that the bulk of shipments in the third quarter were concentrated in consumer HDDs. Enterprise HDD of 10TB-16TB, has recently been shipped a lot, also meet the demands of most of the large andsmall sized customers, but the small capacity enterprise HDD's supply is stillvery tight, mainly concentrated in 1TB-2TB - especially 1TB which is extremely hard to find! -HUS722T1TALA604 this is the flagged material as it is in huge shortage.There are no delivery date and subject to allocation.

3. Recently, the demand for SSDS is also chasing up.240GB and 480GB of S4510 and S4610, which are commonly used series of Intel SSDs, are still out of stock. Agents have almost no stock and can only try to buy some goods from the market, but the quantity is not large. Quiksol has long-term demand, do contact us if you have the supply.

4. Soon into the fourth quarter, we foresee that the demand of HDD will continue, if you need to keep stocks, now is the time!

If you want to have business with us, please contact our disty sales:

Mr. Zhang:+86-183 6275 0919

Ms. Yang:+86-180 5109 2629

Ms. Yao:+86-135 1055 9053

If you have enquiries, please send e-mail to RFQ@quiksol.com.cn

If you want to communicate with our professional buyers, please contact

Memory@quiksol.com.cn HDD@quiksol.com.cn CPU@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat