Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands: Micron,Samsung,Hynix, Nanya, Kioxia, MXIC, Winbond,CPU.HDD

Overview: The memory market has been relatively stable recently. The current memory market can be said to be at a node in the supply-demand game. The upstream supply side is still optimistic about the market outlook. It is predicted that the price of Q3 products will continue to rise, while the downstream demand side and spot merchants are waiting to see the follow-up market. The market has been relatively slow in recent transactions, and factory-side customers are also bearish on the market outlook. At present, the market is not clear. You need to always pay attention to the supply and demand side dynamics, and don't blindly sell at low prices orchase high.

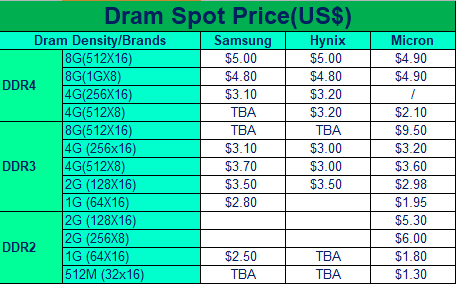

DDR4 As the demand for servers and PCs has been stable recently, the supply of DDR4 is still in short supply,the inventory level of spot vendors in the market is low, and prices have also fluctuated within a range recently. The price of Samsung 4Gb fluctuates between US$2.75-US$3.20, and the price of 8Gb fluctuates between US$4.65-US$5.0. The market has a strong atmosphere for buying and finding goods. As for Micron,DDR4 8Gb has sufficient inventory. At present, the delivery is relatively slow,and the price must be won. The original factory plans to continue to increasethe shipment price in Q3, but whether the price will really rise, we still need to wait and see the acceptance of the factory client. As for NANYA, output and demand are relatively flat, and the follow-up still needs to wait and see.

DDR3 Since May, DDR3 products have fluctuated within a range, and there have been price differences among models. The price of Samsung 4Gb BCNB is about US$2.80, and the price of BYMA is about US$3.10. The price of 2Gb has been slightly corrected recently, and the price has also risen from the US$4.20 fell back to around US$3.20. For Micron, the price of 4Gb is around US$3.20, and the price of 2Gb is below US$3.00, which has been maintained at this price level for some time. The price level in NANYA is the same as that of Micron. Given the relatively sufficientsupply, there is little room for price increases. DDR3 is mainly used in consumer electronic phase difference products. The demand for consumer electronic products is still stable, and the original supply side has not been loosened, and the price may be difficult to reduce. It is safer to prepare appropriate inventory at the low point of price fluctuations.

DDR2 In recent years, most of the customer’s demand are DDR3, DDR4, and DDR2 demand is not as good as before.Perhaps it is because the demand for DDR2 is relatively low, and perhaps part of the original factory's production capacity was moved to DDR4 and DDR3, which were in big shortage at the beginning of the year. As a result, DDR2 is in big shortage recently, and the price has also increased by more than 20%. The main parts that are out of stock are 1Gb 64X16, 128X8, 32X16 commercial grade, and industrial grades are all lacking. In addition, Samsung 32X16 also has a lot of demand to find goods recently, but it is difficult for the original factory to get the distribution, making the spot market a huge increase.

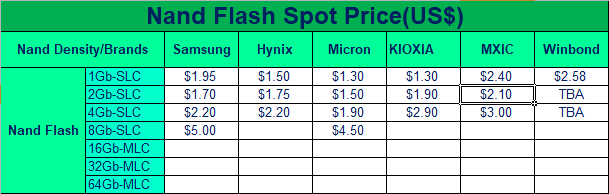

Nand Flash Micron’s Nand flash has been in sufficient supply recently, and the price has remained at a relatively high level. For Winbond and Macronix, after several rounds of price increases for Nand Flash, the price is now at a high level, but the transaction is relatively flat. From the supply side, the overall supply performance in the second half of the year is not expected to be very good.

Nor Flash As for Micron, a small amount of stocks are occasionally released in the Nor flash market. From the source, the supply situation is not optimistic. The delivery period continued to extend to the end of the year, and the market prices of some material numbers were even increased by several hundred times. I wonder if customers can accept such a high price difference. For Winbond, the demand for Nor flash has declined this month, leading to a slight downward adjustment in the marketprices of some general-purpose part numbers that have soared up, but the pricesof some particularly lacking parts are still high. According to the feedback from the supply side, the shortage of goods has not been alleviated, and the distribution of goods is still very small. In addition to the serious epidemicin Taiwan, it is reported that the production capacity of the packaging and testing plant has been greatly reduced. Macronix has received news from theoriginal manufacturer that due to the production capacity problems of the packaging and testing plant, there will be major delays in delivery of some models, and prices will also increase in the third quarter.

EMMC Since May, Samsung's EMMC market has dropped significantly due to the large number of arrivals. Recently,prices have remained stable and demand has been relatively deserted. At present, the price of 4GB is maintained at around US$2.10, the price of 8GB is around US$2.85, and the price of 16GB is around US$4.90. The price of 32GB is very short not long ago and the price has risen sharply. In the past half month, more goods have been delivered, and the price has continued to fall. The current price has dropped to Around US$8.0. The upstream side reflects that the follow-up supply of EMMC is still in short supply, and everyone can pay close attention to the fluctuation trend of EMMC and maintain a certain amount of safety stock appropriately. For Kioxia, the supply trend is the same as that of Samsung, and 32GB is still out of stock. Unlike Samsung and Kioxia, Micron EMMCis still very out of stock, mainly 4GB, 8GB commercial grade industrial grade,the market price is rising steadily, and the goods that can be distributed arevery few. The delivery time of EMMC reported by the original factory is notoptimistic. If there is a demand, try to cherish the spot.

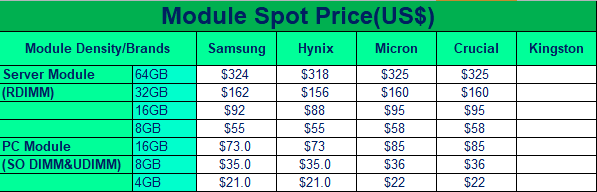

Memory Module Since mid-to-late May, the price of PC memory modules has been reported more, and the price has dropped significantly, and many channel vendors have sold inventory to cash out. Spot traders in the market are more cautious in buying goods and are not optimistic about the market outlook. The May transaction on the server side is not ideal,and the client side is more on the sidelines, indicating a bearish outlook.However, the new official price of the original factory in June was much higher than that in May. Although there is demand from the factory, it is difficult to buy the low price in May. The demand for orders that are not urgent is also a wait-and-see state. I believe that the coming of Q3 next month will make the market outlook more clear.

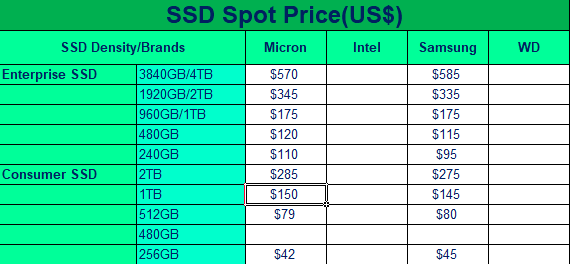

SSD Since the beginning of themining boom at the end of April, there has been a shortage of high-end solid state hard drives, and their prices have sky rocketed, with price increases as high as 50% or even doubled. However, at the end of May, the market suddenly turned sharply. Due to too many orders, the market had a large backlog of inventory. Spot merchants sold their goods to cash out, causing prices to drop rapidly or even upside down, and no one was willing to take orders. However,the original supplier is still in short supply, the contract price continues to rise, and terminal demand is relatively stable. It may be necessary to wait for the market spot inventory to digest, and the spot market will improve. At present, the most shortage is the small capacity 240GB, and there is more demand for finding goods, so you can focus on the original factory arrival dynamics.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

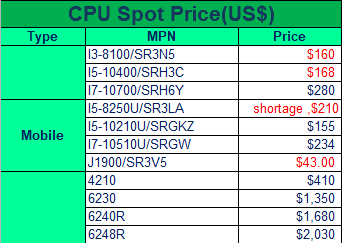

In June, the price and supply situation of INTEL LAN chip have some changes, pricehave drop about 30% but from the INTEL side, the lead time is still long at about 40-50weeks. Other hot items will be I3 DT, and low end Mobile E3845, 3867U etc. also XEON 4 generation price moving up about $60-80 each – ie. 4210, from $350 to $400,

1.Notebook, E3845 and 3867U 3865U is the hot items, huge shortage and hard to find parts, if you have offer, please do contact us. Other items like J1900 andJ1800 is experiencing a price drop and for NB mainstream parts like I5-10210U and I5-1135G7 because of quote end, price have drop and some FD and OEM customer like to sell the parts before Q3. I5-10210U price is about $155 now and1135G7 price is under $180 now and it is negotiable.

2.DT: I3 is the most shortage parts, from I3-6100 t, 7100, I3-8100, 9100, 10100 –all are facing tight supply. We can see some offer of these parts, price is high, like I3-8100 priced around $160 and parts moving fast, 6100 also is short.Other I5 like 9400, 10400 price have drop, about $2-5 each .At present, I5-10400 price is about $165 and demand is not good.

3.Server : 4210, 4208, 4214, 4210R is the hot items, price moving up a lot. However, others are stable ie. The 5th and 6th generation parts. AMD price have drop and we can see offer from market . Due to the dropin BitCoin market, we need to monitor the market closely to see what will happen soon.

4.IOTG: INTEL LAN CHIP lead time maintains at 40-50 weeks but as customers arenot willing to buy at high price so customers are not buying INTEL Lan chiprecently. Especially for the main stream parts like 211AT,210AT, price have dropsome although the supply is still tight. Some stock keeper want to sell some to take money back and recently Chipsets also in tight supply - H110 ,QM170 Q170 all in high price, the shortage and price keep high is 350AM serials.

Pls take as a reference of below table.

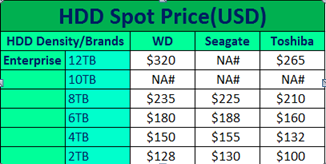

HDD

1. As we see the whole market, the enterprise HDD is still in shortage, for high-capacity HDD such as 16TB and 18TB items, there is some stocks from market, but for small capacity parts 1TB and 2TB are really hard to seek stocks. The most reason is manufactories promote the production tohigh capacity HDD, so that the small one is in huge shortage and it has been 2-3 months no stocks can move.

2.Compared the price with May, there was an obvious falling, for example the Seagate 8TB parts, the part number is- ST8000NM000A, the price in May is around US$260.00, but this month, the price is around US$225.00, the price changed relatively fast, so as other high capacity parts.The price of small capacity enterprise item is relatively chaotic, mainly because there are no goods, so that if there is small quantity parts, the priceis very high.

3.The supply of the consumer and notebook items isalso quite tight, currently the manufactories are directly supporting the big OEM customers, for the small and medium-sized OEMs can only share the goods, the quantity is also very limited.

If you want to have business with us, please contact our disty sales:

Mr. Zhang:+86-183 6275 0919

Ms. Yang:+86-180 5109 2629

Ms. Yao:+86-135 1055 9053

If you have enquiries, please send e-mail to RFQ@quiksol.com.cn

If you want to communicate with our professional buyers, please contact

Memory@quiksol.com.cn HDD@quiksol.com.cn CPU@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat