Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands: Micron,Samsung,Hynix, Nanya, Kioxia, MXIC, Winbond,CPU.HDD

Overview: Entering Q3, the manufacturer prices have increased but the market prices have declined. The prices of most consumer memory models have fallen sharply, especially those from Samsung. Due to the shortage of raw materials in the first quarter, major OEM factories panicfully stock up a large amount of goods. The current inventory level is high. With the increase in upstream channel shipments, the market has continued to fall recently and demand has been sluggish. Of course, there are also some cases where some items are still facing big shortage and some items are still having a lot of stocks in the market. The out-of-stock items are still in short supply and the price is high. In the past month, we can clearly feel that the memory market has calmed down a lot, and the demand has decreased significantly. At one hand, the manufacturer continues to supply DDR4, DDR3 and other common items, which is not as short as before while on the other hand,the end customers find it difficult to accept such high prices. Once there is a stock offer with special price, customers can still place the orders very quickly.At present, the most shortage item is still Micron EMMC, and Nor flash of various brands. This year’s market is different from previous years. Although the peak season is coming in the second half of the year, we don’t know whether the memory trend of previous years can be continued this year. There may be too many variables in this quarter, and we need to pay more attention to OEM demand and market trends.

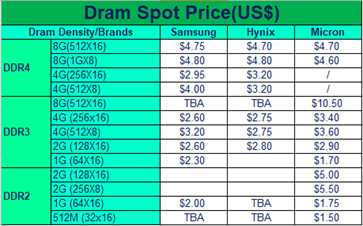

DDR4 The DDR4 market has been relatively stable recently, supply and demand are balanced with small fluctuations.However, after entering the third quarter, the performance was not satisfactory this month, you can find that demand began to weaken and prices continued to decline. The price of Samsung 4Gb is around US$2.90, 8Gb is around US$4.70. The price of Hynix has also fallen. 8Gb has received more goods this month and the price has dropped to about US$4.60, which is already lower than the original shipment price. Some upstream companies are unwilling to sell inventory at low prices. The future trend is not yet clear. It is necessary to pay more attention to the manufacturer shipment dynamics. As for Micron, the recent supply of DDR4 has been stable and the price has been steady and decreased. There is a target price to discuss a large quantity of demand which will speed up the transaction speed.

DDR3 The price of DDR3 has fallen sharply in the middle of this month and the demand has been weaker than before. The price of Samsung 4Gb is about US$2.70; the price of 2Gb has recently fallen severely and the price has dropped to about US$2.50. Hynix can only follow the decline and the price of 4Gb dropped to around US$2.75. Due to the serious shortage of DDR3 in the first half of the year, many end customers placed orders to the manufacturer. Due to urgent demand, they adjusted a large amount of spot goods. Recently, more inventories have flowed from the factory to the market, which has made the market downturn even more intense. For Micron, some non-generic DDR3 orders have long lead times, and there are still no signs of relief. However, the supply of general-purpose DDR3 is stable and whether customers purchase it depends largely on the price. It is indeed because after the price of DDR3 has risen to a certain level, the acceptance of end customers has become lower. For example, if the price of DDR3 2Gb is below US$3.00, it will speed up the customer's order decision speed; if there is a large demand for DDR3 4Gb, the price will rise slightly. Once the demand is full, the price will quickly fall which to a certain extent shows the market inventory The amount is relatively large. For Nanya, its own production capacity is relatively small,but it has recently been able to meet customer needs. The price is slightly higher than that of the three major brands. It is expected that subsequent prices will still fluctuate with the trend of the three brands.

Nand Flash As for Micron, there is no major shortage of Nand flash. Inventory has been released one after another,and the price is basically stable. For Macronix, the supply is still insufficient, but the demand does not continue, while bursts with the timing of the purchase of major customers, the original delivery time is not optimistic,and the price is still on the upward trend. For Winbond, the demand for Nandflash is not very strong either.

Nor Flash MicronNor flash has been out of stock for more than half a year. During this period,the scattered shipments could not fully meet the needs of existing customers and the market price once soared to ten or even a hundred times. It is not sure whether this price can be traded. At present, the short-term Nor flash shortagecannot be completely relieved for the time being and there are still many orders from last year that have not been shipped. It also makes the end customers adjust the spot in the market one after another. This situation continues. Once the original factory can deliver all the system orders, it will inevitably cause some sluggish inventory. Similarly to Cypress, due to the original production capacity of many orders, the delivery date continues to be delayed, and the market spot rises accordingly. Although the price increase is less than ten times or 100 times that of Micron, there are also three to five times price increases. Customers are careful to plan and buy urgently needed materials, and for the rest, they can only wait and see the follow-up market.For Macronix, the number and the speed of transactions have declined recently,but from the perspective of the original delivery date, the follow-up deliveryis still not optimistic, the official price is also continuing to rise, and the demand side situation is also constantly changing. For Winbond, demand has declined and end customers are more sensitive to prices. The arrival situationin August may ease. The demand for PCs, servers, TVs, monitors, and WiFi6 continues to grow. There is also news that demands is still strong in the fourth quarter, let us wait and see.

EMMC Samsung's EMMC market has more supplies from upstream channels in recent times. Prices have continued to fall this month, and demand has been relatively deserted. At present, the price of 4GB is around US$1.90, 8GB is around US$2.60, 16GB is around US$3.50, and the 32GB is around US$6.00. Due to the recent decline in the price of EMMC, the price has fallen to a relatively low point and has been lower than the original Samsung factory shipment price. Therefore, whether it will continue to fall in the future, it depends on the end customers’ demand. A similar brand - Kioxia,although the decline is less than that of Samsung, the market has become deserted. Inquiries and transactions are very small. Even if the originalmanufacturer is insufficient in supply, the market still has no vitality. The big difference is that Micron's EMMC is very out of stock in recent months, mainly because the IC controller is out of stock. Almost all orders are scheduled for delivery for more than half a year, which has also led to a surge in spot market prices, and end customers are being forced to accept high-priced purchases to ensure production.

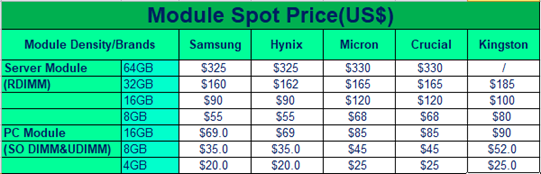

Memory Module Recently, the demand for PC memory modules has been poor and fluctuating downwards. The upstream channel inventory sales pressure is high coupled with high cost pressure, causing the prices of some products to continue to invert, especially at the end of the month,channel vendors sell their inventory at low prices to cash out. The market spot merchants' desire to buy goods is even more sluggish and the market be havesvery quietly. The transaction of the server-side memory module was not satisfactory this month. The manufacturer increased the price in the third quarter, but the client side was more on the sidelines, saying that it would not accept price increases, and the demand was not eager, so it was also very depressed.

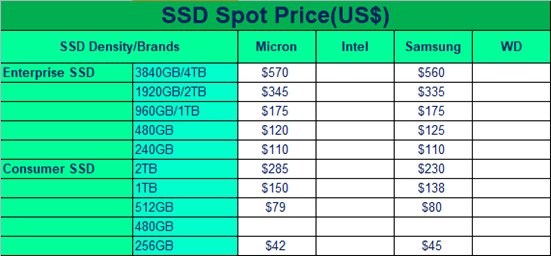

SSD Since domestic mining machines were suppressed, the demand for solid-state high-end hard disks has continued to decline and the market is very sluggish. At present, there are still many spot merchants dumping inventories, causing prices to continue to fall. However, the original supply is still in short supply, especially for enterprise-level solid state drives, and the contract price for the third quarter is still rising. At present, it is necessary to wait for the market spot inventory to be digested as soon as possible and the market may return toits normal trend. However, the price has fallen indefinitely recently, and the quotation is relatively stable, and there should not be much room for decline.The current shortage is PM883 with a small capacity of 240GB. There is a lot of demand for finding goods, but hardly any allocation is available. The price is close to 480GB capacity. Pay close attention to the arrival of the manufacturer.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

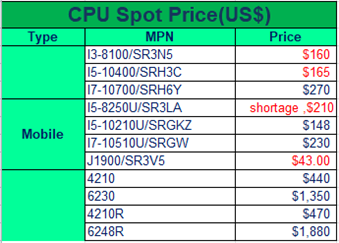

INTEL except CPU, the main situation is not good, most of the mainstream partsinclude DT and Mobile also XEON price is going down, demand is weak, the hot parts are from IOTG, ie. E3845, E3940, 3855U, 3865U, 3955U, Z8350 etc , and Chipsets, ie. H110, H410, B460, Q170 all in tight supply, price also moving up. Also, hot parts is LAN Chip, the leadtime is still bad at about 50 weeks. However, recently the market is too high and customer will not pay such high price to buy LAN chip causing the market to quieten, from Jun on wards. We understand from reliable source that there will be new incoming from INTEL, so we forecast the price of LAN chip to drop in the next 2-3 weeks.

1.Notebook:quiet market. Mobile CPU have less transaction on market. I5-10210U, I5-1035G7, price all drop $10 each at least, but still no buyer. The 11th generation also face same situation, price drop and market continue its silence.

2.DT: only low end CPU face tight supply, others keep stable. Shortage item is I3-11100 and G6400 .

3.Server :4208,4210, face shortage and 4210R is the facing huge shortage. Supply is bad and price already hit $460+, the normal price of 4210R is only around $350, means there are $100+ each of price increase in past 3-4 weeks, and the supply will maintain at this situation as there is no visibility of any big quantity supply in next 1-2 weeks. Other items of XEON are quiet, some models even face price droppingdue to weak demand.

4.IOTG: the hottest INTEL group, including the E3845, E3940, Z8350 chipsets, LAN chip are all shortage items. H410 price has reached $33 and from $26 one week before. H110 also facing shortage.We still cannot see any firm offer from supply side, other items like Q170, H310Calso in tight supply. LAN chip is a good product to deal, but it is also not easy. From June to July, the price of LAN has been going downtrend. For instance, I211AT price drop about 50% from the highest, $20 to $10 or evenlower. Demand from customers is weak, lot of customers show low TP and not easy to deal, but in next 2-3 weeks this situation may have chance as INTEL have new incoming for each model and quantity is good. We forecast the LAN chip price will continue to drop and lot of deal will close as price drop, let’s pay more attention on this market to find some good chance to deal .

Pls take as a reference of below table.

HDD

1. Recently the price of HDD market is not stable and dropped, especially for the high capacity parts, the price is changing everyday, the whole trend is moving down.

2. For example, the 8TB items is what we do most, the price at the beginning of May and June is around US $240.00, but at the end of June the price drops to US $220.00, and recently the price is around US$180.00.

3. For the small capacity enterprise HDD parts is still in huge shortage, especially for 1TB items, there is few stocks in market, and the price is confusing, it is around US $115, Quiksol has some demand of this capacity parts, if you have stocks, please contact us;

4. The supply of the consumer and notebook items is still in big shortage, currently the manufactories are directly support the big OEM customers, and for the small and medium-sized OEMs can only share the goods from the market at very high price, or they need to wait the long lead time.

If you want to have business with us, please contact our disty sales:

Mr. Zhang:+86-183 6275 0919

Ms. Yang:+86-180 5109 2629

Ms. Yao:+86-135 1055 9053

If you have enquiries, please send e-mail to RFQ@quiksol.com.cn

If you want to communicate with our professional buyers, please contact

Memory@quiksol.com.cn HDD@quiksol.com.cn CPU@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat