Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands: Micron,Samsung,Hynix, Nanya, Kioxia, MXIC, Winbond,CPU.HDD

Overview: Recently, the popularity of the memory market has continued to decline, it seems that the market is entering the winter season and demand is very sluggish. Since June, DRAM prices have been declining from its peak. The decline has been more serious in recent weeks. The acceptance of price increases by end users has gradually slowed down and the market spot price seems to be slowing down. There is news that the manufacturer will supply in large quantities soon, which pushes the OEM customers and the brokers dealers back to the wait-and-see attitude. Some of them have lowered their prices and focusing on selling more quantities. A few materials that were originally in short supply are gradually arriving this month. Prices returned to normal levels. Some professional organizations believe that the manufacturer will lower the memory contract price in the future, but it will not lower it too much. This will then start to stabilize the market. The memory market may continue to be sluggish in the third quarter. We hope that the demand for industry products will increase in the fourth quarter. In short, everything is still demand-oriented.

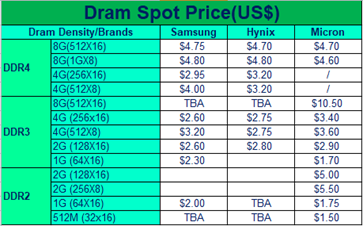

DDR4 The price of DDR4 products has fallen sharply this month, the market spot price, especially 8Gb, has been far lower than the contract price. Recently, a large number of spot releases from the upstream channel, coupled with the original weak demand, made the wait-and-see sentiment even stronger. However, there are still some demands for orders, but the target price is low, the demand side and the supply side are often in a state of price stalemate, making it very difficult to close anydeals this month. The spot price of Samsung's 4Gb market is around US$2.65, and the price of 8Gb is around US$4.20. The DDR4 4Gb UHC that Hynix was in short supply has gradually increased this month, the price has returned to its norm. Recently, due to the increase in the supply of goods and the weak demand, the market continues to decline and more attention needs to be paid to the demand of end users in the future. Micron's DDR4 spot supply is abundant and the target price on the demand side is low. The transaction requires close communication between the supply and demand sides.

DDR3 The price of DDR3 products continued to decline this month. The supply of DDR3 1Gb and 2Gb which were previously in short supply has gradually increased. Perhaps due to weakening demand, the spot market prices have continued to fall. DDR3 has been very weak this month. The end users demand is weak and the spot merchants in the market are not optimistic about the following market and are afraid to stock up. The price of Samsung 4Gb is around US$2.45; the price of 2Gb is around US$2.50. The price of Hynix 4Gb dropped to around US$2.60, and the price of 2Gb was around US$2.50. The price of Micron DDR3 has dropped significantly compared with last month. The price of 4Gb is finally back to the state where the market price is better than distributors’ price. The price of 2Gb has fallen sharply, and stocking must be with cautious. It is still necessary to focus on end customer’s demand.

Nand Flash The overall price has dropped this month including the prices of SPI and SLC Nand as the manufacturer has successfully supply the parts. Among them, Macronix's prices have fallen, and the supply side is busy with demand. The price drop this time is not due to the ease of delivery, but the lack of stamina for customers to purchase. Winbond’s situation is similar. Prices have fallen and supply is sufficient while customer demand has slowed down and transactions have been relatively small. The supply and demand of Micron Nand flash were relatively flat, and the prices are declining.

Nor Flash Throughout August, demand was relatively flat, but some parts were still out of stock. In terms of Cypress, due to the manufacturer's abandonment of the small-capacity market,the lack of large-capacity production capacity and the elongated delivery period, the Nor Flash is out of stock across the board, the market premium is serious, some parts are difficult to find, coupled with the uncertainties in the delivery date. As for Macronix, there is still a shortage and the manufacturer has reported that the delivery time is still not good. On the other hand, client demand has also slowed down and the prices of some parts have been slightly lowered, but the subsequent delivery date is still not optimistic. For Micron,the shortage has not yet been fully alleviated, and the prices of some part numbers are still high, but customers' willingness to buy at high prices has declined significantly. As for Winbond, demand slowed in August, and market prices slowly fell. The original factories have successively received goods. Due to weak demand, some traders lowered their inventory prices and wanted to ship as soon as possible, resulting in unstable market prices. However, the normal delivery period of the distributors’ orders is still 16-20 weeks. What kind of trend will follow through, especially when the peak season is about to come? We shall wait and see.

EMMC Thereis still a huge demand in Micron's EMMC, and market prices have risen accordingly. The prices of some parts have even increased by more than tentimes. It is reported that the shortage of IC controllers has led to tight supply of EMMC. Samsung's EMMC suppliers continued to arrive this month and prices continued to fall due to insufficient buying on the demand side. At present, the price of 4GB is around US$1.90, the price of 8GB is aroundUS$2.45, the price of 16GB is around US$3.30 and the price of 32GB is around US$5.50. At present, when the demand is not urgent, customers only want to buy at a lower price and the source can only lower the price for shipment and reduce the inventory level. The situation of Kioxia EMMC is similar. The price rebounded slightly this month, but the overall trend fell. Whether EMMC will continue to fall in the future, it depends on end users’ demand.

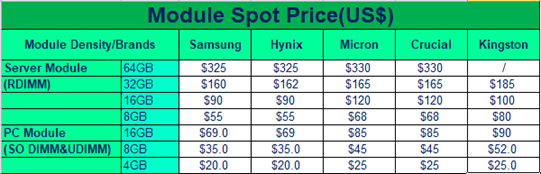

Memory Module Recently, the demand for PC-side notebooks has weakened and the demand for memory modules has continue to decline. The supply-side inventory pressure is relatively high. Although the product cost is high, but in order to keep the stock moving, they can only sell at a loss. Brokers still offer low prices this month. The main focus is to reduce inventory. The market spot price is much lower than the contract price.Only low prices can stimulate some orders. The transaction of the server-side memory module this month is also very unsatisfactory. Although the original factory increased the contract price in the third quarter, the client expressed that it was unwilling to accept the price increase and stayed more on the sidelines. The demand was not urgent, and the market spot continued the price cut was the same as last month's price. Need to pay more attention to the needs of end users.

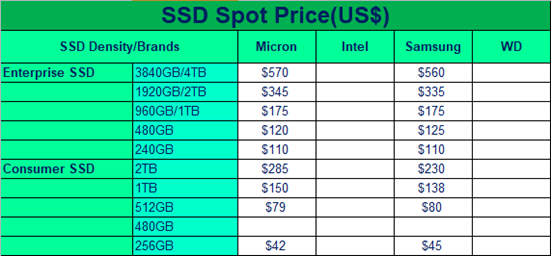

SSD The recent demand for SSD is still sluggish and the market is still upside down. There are more inquiries but fewer actual transactions. Competition in the spot market is fierce and many brokers have reported low prices to compete for orders. In order to stimulate orders, the source side also continued to lower prices and shipments,focusing on destocking. At present, some enterprise-grade SSD have fallen to a relatively low point and there is not much room for decline. The spot price ofconsumer products rose slightly due to partial shortages last month. This month continues to arrive and resumes normal supply. Due to weakening demand, pricesmay continue to fall and more attention needs to be paid to the demand side dynamics.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

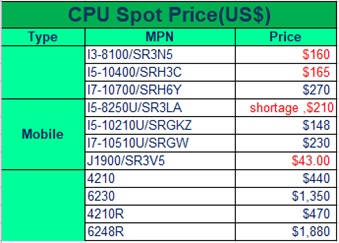

INTEL CPU whole business is weak, only some IOTG and networking model face tight supply from INTEL, case the market price is moving up and less offer, include E3845, E3815, INTEL LAN chip, H110, Q170 chipsets and i3-8100, i3-6100 model.

1.Notebook:mainstream model all in over supply, price going down, I5-1165G7, price now $240+, compared with before $270 have a $30 drop. the main reason is weak demand, not the end customer do not show demand but some IC shortage and some region’s policy make the weak demand of Notebook from some COEM , N4200, J4215 distributor’s side have plenty of parts and price can negotiate.

2.DT: price is stable, and demandis also stable, AMD show some shortage, but INTEL side as the supply side is better than AMD, not showing any good opportunity to deal.

3.Server :4208,4210, face shortage and 4210R is the face huge shortage, and some networking equipment CPU like D-1508, D-1548 etc, shows big demand, just as tight supplyfrom INTEL. Prices are also dropping for another main model like 6226R, 6248R.

4.IOTG: Lan chip, as INTEL have a good supply in Aug. 2 series show good activates in the market, price is starting to drop, and customer begin to buy. WGI211AT, price drop to $6.5-$7, end customer finds the price acceptable, and start to buy. Also, WGI210AT, price drop to around $24, and show more demand from customer side, some huge shortage items like 210IT, 210IS all have supply, but price maintain high, like 210IT price is about $70+. Chipsets are also facing tight supply, H110, H410, Q170 all is the shortage items and now B460, B560 show demand from end customer side.However, distributors do not offer any parts, price moving up but still in saferange, means end customer still able to accept, like H410 $30+, B460 $44+, all IOTG items have a good deal chance.

Pls take as a reference of below table.

HDD

1.Over all the whole market, the shipments of major manufacturers for HDD have a big increase than the first half of last year. Especially for the large capacity parts. In March and April this year, as ChiaCoin became popular overnight on the Internet, the demand of HDD, with capacity ranging from 8TB to 18TB, and prices nearly tripled. Some small and medium-sized factories are forced to change to use monitoring HDD instead of enterprise HDD because of the market shortage, or unable to afford such a high price. The performance of monitoring HDD may not be as good as that of anenterprise HDD, but it is still much better than that of a consumer HDD.

2. Since the end of the second quarter, we have seen some large capacity HDD come out of the market, and the price has decreased significantly, and the price changes every day. However, we can also detect that the enterprise small capacity HDD, such as 1TB~2TB parts,is still very short, almost can't see any stocks, the delivery time of original factory and the FD has been more than 16 weeks or even longer.

3.This wave of price fluctuation of HDD also drives the demand of SSD at the same time, resulting in the SSD is also facing serious shortage, 240GB~3.8TB goods can hardly see, the price of the stock has doubled several times.

4.Quiksol deals with plenty of these HDD and SSD, if you have any demand, please feel free to contact us.

If you want to have business with us, please contact our disty sales:

Mr. Zhang:+86-183 6275 0919

Ms. Yang:+86-180 5109 2629

Ms. Yao:+86-135 1055 9053

If you have enquiries, please send e-mail to RFQ@quiksol.com.cn

If you want to communicate with our professional buyers, please contact

Memory@quiksol.com.cn HDD@quiksol.com.cn CPU@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat