Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol which delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands: Micron,Samsung,Hynix, Nanya, Kioxia, MXIC, Winbond,CPU,HDD.

Overview:

In the first quarter of this year, there was a serious shortage of storage products, and the spot price increased significantly which was far from the contract price. Entering the new quarter Q2, storage capacity is still in short supply, and product’s contract pricing have increased by about 20%, narrowing the gap with the spot market price. Major original manufacturers expect this shortage of DRAM to continue until the end of the year. Due to the continuous shortage of main control chips on the FLASH and SSD side, I am afraid that the delivery time will continue to be lengthened.

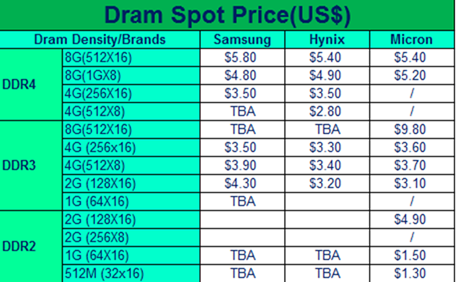

DDR4 Recently, most of the demand is concentrated in the DDR4 4Gb part. A few days ago, due to the big customers receiving the goods in the market, the market price has increased greatly. In addition, the factor of the Q2 contract price increase, the customer acceptance price also increased. The price of Samsung DDR4 4Gb has recently risen from US$2.60 to around US$3.50, and the price of DDR4 8Gb has risen to around US$5.8. The supply of Hynix DDR4 4Gb is very short, and the stock in the market are lesser. It is difficult to get the original distribution; the price of 8Gb is stable at about US$5.5. At present, many end customers still have a large demand gap. According to the original storage factory, it is expected that the shortage will continue until the end of this year. The market price will fluctuate up and down with the demand side recently. You might consider getting in the inventory when the market price drops. Micron's price is nearly 10% to 20% lower than that of Samsung, and stock is still available.However, most customers who use Samsung cannot use Micron as a substitute. In Nanya,the output is very small and the price is much lower than that of Samsung.

Nand Flash Since the Spring Festival, many brands of Nand Flash have been out of stock. Some are out of stock and serious, such as ESMT, and some are out of stock one after another, such as Macronix. Winbond’s Nand Flash1Gb is also out of stock, and the market price has even been reported to morethan US$2.00. The spot price of Micron’s 8Gb Nand Flash once soared by 40%~50%.Due to the reduction in electricity meter usage for more than half a year lastyear, the supply side did not have enough safety stocks for 1Gb and 2Gb SLV. Recently, the volume of electricity meters has increased sharply. Leading to the rapid increase in prices of this part.

Nor Flash For Winbond, the price of 1Gb remains high, and the market price is above US$2.00. It is difficult to find the spot of 2Gb. For Macronix, the supply is insufficient, and the price is steadily increasing. The delivery date has not improved, and the supply side expects that the price will continue to rise. For EXMT, the supply continues to be in short supply, and the price has increased by 20-30% compared to previous month, and the amount of goods that can be allocated is very scarce; the price of Micron 2Gb SLC hasrisen to around US$1.60, which is a bit unmovable. 8Gb is relatively out of stock, and the price has more than doubled. In Kioxia, similar to Micron, the price has been stable recently, and is not many huge demands. In summary: small brands have been mainly lacking recently, and large brands have been stablerecently.

EMMC In Q2, the price of EMMC products has increased by about 20%. With the recent substantial increase in product-side demand, EMMC products have risen again. The current supply is very short, especially for the large-capacity parts above 16GB, and the spot price has risen wildly. The price of EMMC 4GB is currently around US$3.30, the price of EMMC 8GB is currently around US$4.40, the price of 16GB has risen from US$6.50 to around US$8.50 injust a few days, and the spot price of 32GB has risen from US$12.00 to around US$15.00 in just a few days. The terminal factory wanted to wait for the Q2 shortage to ease and reduce the purchase cost, but it seems that the shortage situation is difficult to alleviate in the short term. It is best to have stockon hand if there’s demand in near future. Samsung/Micron/Kioxia/SanDisk EMMC4GB and 8GB are all very out of stock. The subsequent delivery date is not optimistic, and the delivery price cannot be determined. It is recommended that customers to get stock as much as possible.

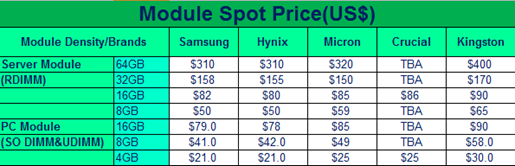

Memory Module Q2 The price of memory modules has risen by 15% to 20%. Server memory modules are still in a very short supply, and many major customers have come out to find goods one after another. The current contract price has been equal to the spot market price, and the spot market can only satisfy a small number of orders. In the short term, server products are still difficult to be all eviated, and it is better to prepare corresponding inventory. In addition, the PC memory module has seen a huge increase since Q1. Since the price has risen to a high level,it has been relatively stable recently with small fluctuations. Continue to pay close attention to the supply status of the original factory.

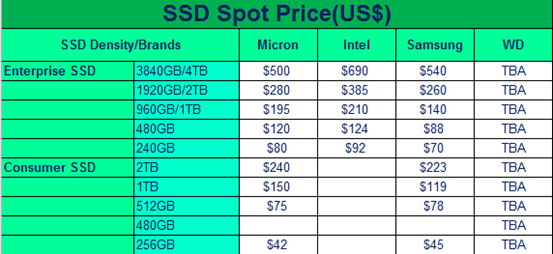

SSD The contract price of SSD in the Q2 has increased by about 8%. At present, the supply of SSD main control chips is still insufficient, resulting in delays in delivery, and channel vendors have a small number of spot prices and not many quotations. Due to the expansion ofserver-side and data center demand, and the large number of inquiries, the spot quantity cannot meet the needs of the client at all. Only orders can be placed and the order delivery time is as high as about 8 weeks. SSD prices have bottomed out, coupled with the increase in demand, this trend of out-of-stock price increases is likely to continue. It is recommended that those in demand should prepare appropriate safety stocks as soon as possible.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

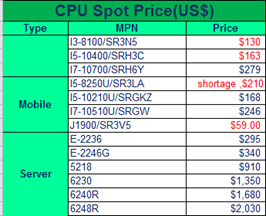

As we approach April, INTEL different product have different preferences.XEON, Mobile CPU mostly are stable in the market, but some small LAN chip and South bridge face serious shortages, and price moving up quickly.

1. Notebook, Low end mobile parts still in demand,like J1900, J1800, E3845 - price keep moving up. J1900 price is about $57 and E3845 price around $68. But main stream Mobile CPU like I5-10210U, price drop and maintains at about $168. I5-1135G7, I7-1165G7 price stable, as demand from OEM customer not big, which causes CPU sales to be slow thus keeping the price stable.

2. DT : more shortage than Mobile, INTEL have just announced 11 generation CPU but the supply is mainly focused on big OEM customer, so the market do not see much supply from INTEL. It causes 10 generation price moving up , like I5-10400 price now $160+ and I3-10100 price is $120+ or more higher,but high end 10 generation as mostly for gaming DIY customer, they are all waiting for 11 generation so the market is quiet and not easy to sell like I9-10900. AMD side still faces shortages for mostly all product line. Low and highend DT all face shortage.

3. Server - AMD EYPC keep shortage, and INTEL also have announce new XEON, the preference is 50% higher than old XEON. As we are now waiting for thearrival of the parts, others old items price maintains or drop slightly. Only Eand W series face shortage. Please offer to us if you have E-2236 or E-2224G, E-2276Gas we have demand for such model.

4,IOTG: LAN chip seems crazy on the market, price moving up daily.Vendors who have parts are all holding them to wait for higher price. Whole market is not reasonable now but with the shortages faced by customer, they have no choice but to succumb to this situation. We forecast all the LAN chipmodel price will be on an uptrend. 8 generation DT face shortage, 8100, 8400such CPU is mainly for Education market. 9 generation supply also not good, and INTEL WIFI is also facing shortage. AX200 price is moving up from $11 to $22 oreven higher now. Recently the market especially for low value chip market is crazy, not easy to deal with. We have some stock offer:

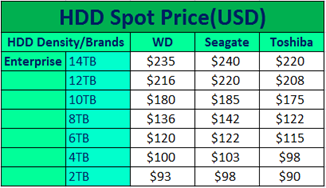

Overall the whole market, it is still very hot and crazy. The HDD manufactories are also short of raw material, so that the lead time is longer than before.

The consumer HDDs are in big shortage for some time, especially for2.5inch parts. For SSD, such as WD, Seagate, Intel brands the low capacityparts which is below 128GB are out of stocks, due to the manufactories have diverted the raw materials to make the productions into the high capacityparts. Therefore, at present, the supply of large capacity products such as10TB, 12TB and 14TB is relatively stable. Quiksol also has stocks, if you haveany demand please feel free to let us know.

The price of consumer and enterprise HDD have raised a little. There are chances that it will continue its uptrend.

If you want to have business with us, please contact our disty sales:

Mr. Zhang:+86-183 6275 0919

Ms. Yang:+86-180 5109 2629

Ms. Yao:+86-135 1055 9053

If you have enquiries, please send e-mail to RFQ@quiksol.com.cn

If you want to communicate with our professional buyers, please contact

Memory@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat