Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol which delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands: Micron,Samsung,Hynix, Nanya, Kioxia, MXIC, Winbond,CPU,HDD.

Overview:

Since Q1, the price of the entire storage product has been rising wildly and the supply could not keep up with the crazy market . It is mainly due to the related applications brought by 5G, coupled with the rapid recovery of automotive use and strong demand in the mobile, server and PC market, which have resulted in a huge price increase in the near future. Entering March, the entire IC industry chain is lack of materials and price increases, which may have a corresponding impact on storage market demand and production capacity. The major storage manufacturers said that due to strong market demand, the supply of Q2 may be even more tight and unable to meet all orders.

Everyone in memory knows that there are many material numbers which are currently lacking, such as Nand flash, Nor flash, Module, EMMC, and prices have all increased in the first quarter of this year. It can be said to be a lot of joy and worry. I was still crying last winter. The prices of some material numbers that have lost money to clear inventory have risen very high recently. Maybe this is the charm of memory. Every day's work is a fresh day, just like riding a roller coaster, never knowing whether it is surprise or fright waiting for you.

DDR4 Recently, the supply of DDR4 is still very tight, and the inventory of market channel vendors is also limited. Since the terminal factory cannot get a sufficient amount of storage from the original factory, it can only buy it from the market at a high price. Since March, the price of DDR4 products has risen sharply. Among them, Samsung DDR4 8Gb has the highest increase, with the price rising above US$5.70, the price of Hynix DDR4 8Gb has risen to around US$5.50, and the price of DDR4 4Gb has risen to around US$3.00. It is understood that many end customers still have a relatively large demand gap, but due to the high market price, they can only purchase a part of the quantity to meet the production capacity, and wait and see the follow-up original factory arrival status. According to the original storage manufacturer, it is expected that the shortage will continue until Q2, and even the supply will be even more in short supply. When the market price drops, the corresponding inventory can be properly prepared. For Micron, the price of DDR4 soared by 20% in early March, and then fell slightly. The price is much lower than Samsung/Hynix.

Nand Flash Since the Spring Festival, many brands of Nand Flash have been out of stock to varying degrees. Some are out of stock and serious, such as ESMT, and some are out of stock one after another, such as Macronix. The prices of various brands have gradually risen to one The horizontal line moves closer. Winbond’s Nand Flash 1Gb is also seriously out of stock, and the market price has even been reported to more than US$2.00. The spot price of Micron’s 8Gb Nand Flash once soared by 40%~50%. Due to the reduction in electricity meter usage for more than half a year last year, the supply side did not have enough safety stocks for 1Gb and 2Gb SLV. Recently, the volume of electricity meters has increased sharply. Leading to the rapid increase in prices of this part.

Nor Flash The shortage of goods that started last year has not been alleviated so far. There is a trend of shortages throughout the year. Looking at the original factories, the production line is fully loaded, but the delivery period is lengthening throughout the year. Customers who have been transformed into full-line shortages and have production needs must not miss out when they encounter stocks. Winbond’s Nor Flash production capacity is fully loaded and overwhelmed. It has not yet eased, and market prices have soared. There is news that Winbond intends to increase prices in the second quarter, but it has not yet been officially announced. Customers in need are advised to prepare as soon as possible and cherish the spot. The price of Micron's Nor flash has been relatively stable in the past two or three years, and it has also been adjusted upwards in Q1 this year. Spot prices have soared. Low-priced delivery orders have also been increased in price after arrival. At present, the delivery time is still relatively long. It is recommended that customers in need do not wait. It is of course good to be able to buy the spot.

EMMC Since the report of Samsung's power outage in the United States, EMMC products have started to rise all the way. It can be said that they have begun a crazy and rapid rise, and soon reached a high point in price. The price of EMMC 4GB has risen from US$2.10 to around US$3.10, the price of EMMC 8GB has risen from US$2.60 to around US$4.30, the price of 16GB has risen from US$3.30 to around US$7.00, and the price of 32GB has risen from US$5.60 to around US$12.00. As a result, it is difficult for terminal factories to keep up with the rapid price increase in the market, and it is difficult to accept such a high price from the market for a while, and some customers remain cautious on the sidelines. However, there are still many customers who transfer goods from the market one after another, worrying about subsequent supply shortages. It is recommended to properly maintain the safety stock and wait and see the supply status of the original factory in the follow-up storage. As for Micron, 4GB and 8GB commercial-grade industrial grades are in short supply. The large-capacity 16GB, 32GB, 64GB, and 128GB are mainly reflected in the car-level specifications. Customers in need are advised to enter the list as soon as possible. As for Kioxia, after the Spring Festival came back, the price continued to soar. Within one week, the price increase reached US$1.00, which was very exaggerated. The current price level is comparable to Samsung, and the overall situation is still out of stock.

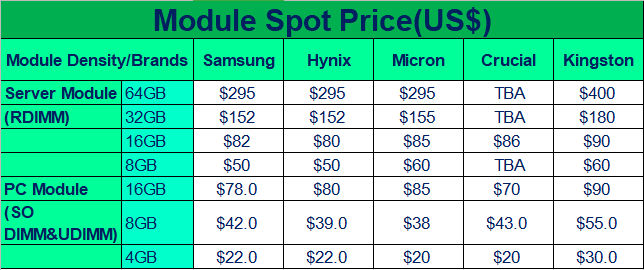

Memory Module At present, server memory products are still in short supply, and the limited number allocated by the original factory is difficult to meet the needs of the terminal. The current spot market price is much higher than the original factory shipment price, which makes it difficult for end customers to accept high-cost transfers from the market, and the willingness to buy goods is not strong. However, server products are difficult to be alleviated in the short term, and it is better to prepare corresponding inventory. In addition, in the PC memory section, the increase has been huge since Q1. The mainstream capacity of 8GB and 16GB has increased by more than 50%. This is mainly manifested in the market channel vendors. Since the price has risen to a high level, customer acceptance may also be affected, which requires close attention. Product trends. For Micron, the price of memory modules in March was already higher than that in February, resulting in a wave of demand from customers, but most of the demand still tends to reach the original February price level. It is relatively difficult at present, and it is reported that the price may be possible. It will be adjusted upwards. If customers in need can do so, please do so as soon as possible.

SSD Affected by the recent power outage in Samsung Texas, the shortage of main control chips is temporarily difficult to alleviate, making all SSD products have a corresponding increase. Coupled with the original factory's intention to promote the proportion of large-capacity SSD shipments, the small-capacity supply is even more scarce, and the increase is more obvious. The demand for notebooks has been strong recently, and brand manufacturers have also increased their inventory in order to meet production needs. In addition, data centers have recently shown strong demand, which should promote a certain increase in enterprise SSDs in Q2. Can closely observe the supply and demand status of the original factory and the factory

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

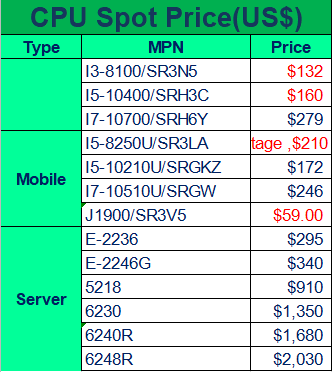

Recently CPU market show the same situation with IC and Memory chip, some CPU (J1900 ) and most of the Lan chip ,price moving up quickly ,some already 2-3 times ,just within 2 weeks .

1, Notebook, J1900 ,J1800 is the star of the product ,price of J1900 moving up from $19 to $50+ now ,and very tight supply from INTEL , but mainstream Mobile CPU like 10 ,and 11 generation CPU price keep stable , I5-1135G7 newest model ,price keep at $185 , and most of the customer not see firm leadtime from INTEL, but as some other IC shortage ,customer not buy CPU with big quantity at this moment ,they are fight with IC shortage .

2, DT Celeron and I3 low end DT CPU face tight supply ,like I3-8100 very tight , and not see big quantity offer on the market , price also moved up to $128 and used to be $105 around , G6400 ,G5400 ,G5420, I3-9100 all face shortage ; but high end I7 and I9 CPU so far in good supply ,price keep stable or even drop some .

3, Server ,,AMD EYPC keep shortage , no one know when the supply will change better ,INTEL side , some model face tight supply ,like 6258R , others model keep stable , just E and D serials XEON CPU face tight supply ,such E like E-2236 ,E-2246G D-1527 etc is not a popular server CPU but lost of factory used them for AI function workstation , and INTEL’s supply is not good , some big OEM customer is looking for on the open market .

4,IOTG: South Bridge and LAN chip ,and wifi now face shortage ,almost all the LAN chip ,and most of wifi parts , like 210AT ,210IT ,211AT ,booking from INTEL have postpone to 10-15weeks or even more time . so market show good demand , and price have moving up to 2-3 times of the original price . 210AT price used to be $2.5 ,and now $6-$7 , and some broker also buy parts for stock and wait for price moving up to new higher recorder ,so the whole market all face tight supply . South bridge ,H410 ,B460 ,Q170 etc all show longer leadtime from INTEL , we forecast INTEL CHIPS WILL KEEP FACE SHORTAGE AND PRICE WILL KEEP MOVING UP .

Pls take as a reference of below table.

Overall the whole market, let us conclude with one word that is Crazy! Yes, the market is really hot and the stocks move so fast... So as the HDD market.

Due to the shortage of enterprise SSD, Micron, Samsung, Intel, the enterprise HDD is also facing shortage. Especially for the high capacity parts 8TB~ 14TB. Of course the most shortage item is 8TB capacity. It has been shortage for almost one month, the two manufacturers Western Digital and Seagate all received lots of orders from many big OEM customers, but not delivered yet. The lead time is over 4 weeks and may be longer than that.

I also heard that the price will raise from next month may be affected by the shortage of materials. In one word, if you really have the long term demand of some parts, you can make a decision of keeping stoks.

If you want to have business with us, please contact our disty sales:

Mr. Zhang:+86-183 6275 0919

Ms. Yang:+86-180 5109 2629

Ms. Yao:+86-135 1055 9053

If you have enquiries, please send e-mail to RFQ@quiksol.com.cn

If you want to communicate with our professional buyers, please contact

Memory@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat