Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands:Micron, Samsung, Hynix,CPU, HDD, TI, ADI, Infineon, TDK, STM, Broadcom, Qualcomm, Microchip.

Overview:The Memory market prices have been falling recently, and some MPNs have also fallen below their previous lows. However, the Memory market as a whole began to rise at the end of August, causing everyone to lose confidence and become active again. Those with stocks continued to increase prices for shipments, and those without stocks chased high prices to buy, making the originally quiet market become warm. But everyone knows that the main factor driving this wave of market reversal is that one big OEM has recently increased its purchasing power and a large number of sweeping stocks due to factors such as the suspension of supplydue to the ban. So can this price increase last forever, or is it a short-term market effect? However, it has to be said that due to the impact of the one big OEM incident, many market spot merchants and channel merchants have benefited. They have continued to sell their newly-prepared inventories at a high price orcleared their previous high-priced inventory. Of course, the subsequent storage market will be a key point in mid to late September. Generally speaking, the feedback from customers on whether they can place orders is faster, and the transaction volume of the entire market has increased. The demand for sourcing of large customers has caused the backlog of memory to be temporarily consumed.During this time, the business of various brands of memory is in full swing.

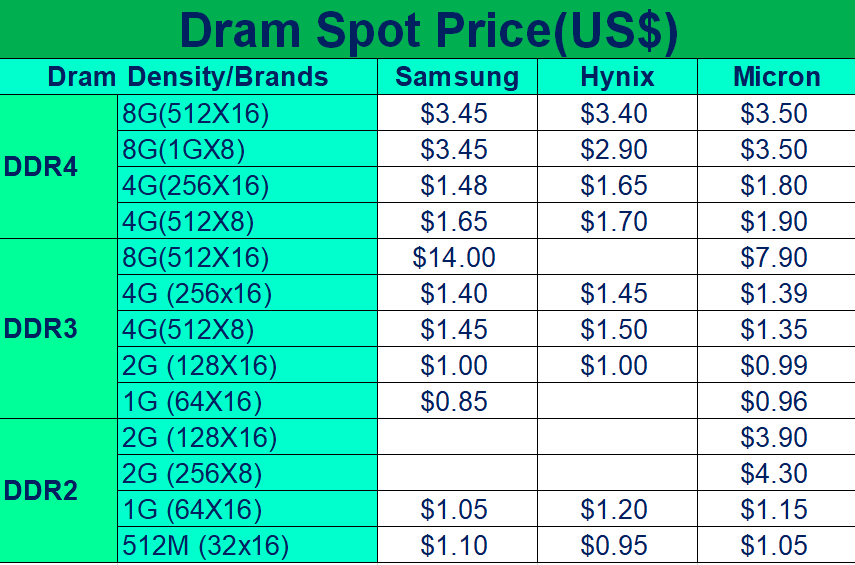

DDR4

The price of DDR4 has been falling continuously in the past two months, and has fallen to a very low level in mid-to-late August, but the transaction and demand are still not satisfactory. However, after the end of August, the market reversed. The main reason was that one big OEM was affected by the ban and received a large amount of goods from the channel and the market. This led to a gradual increase in prices. The spot inventory of channel vendors was also consumed in large quantities. Until mid-to-early September, the price of DDR4 There has been a substantial rise. Mainly reflected in DDR4 8Gb, Samsung DDR4 8Gb price rose from US$3.15 to US$3.45, HYNIX 8Gb 1Gb*8 AFR-UCH price rose from US$2.4 to US$2.9, HYNIX 8Gb 512*16 CJR-VKC rose from US$3.1 At around US$3.5, 4Gb rose slightly, with no significant increase. These increases are reflected in the spot transaction price. For the orders in mid-to-late September, the buyer and seller prices are relatively conservative. Therefore, for the memory trend after the 15th, people in the industry may pay more attention to the follow-up purchase actions of one big OEM. I believe there will be a more intuitive judgment in the second half of September. Micron, DDR4 demand performance continues to be 8Gb DDR4 of 512X16 and 1GbX8, and the demand for 16Gb DDR4 is obviously increasing. In terms of price, Hynix is the cheapest, followed by Samsung. However, Samsung's price has risen slightly in recent days, and it is currently on par with Micron.

DDR3

Some DDR3 prices have been falling recently, and have fallen below the previous lowest point. This makes the market spot merchants and end customers lose confidence in the later market, but there are still some aggressive spot merchants receiving low prices from the channel market. Stock up. DDR3 was also affected by one big OEM’s recent purchases. The price started to rebound slightly from the end of August. Until mid-to-early September, there were a large number of receiving and buying inquiries, and channel spot vendors continued to raise prices. Shipments and transaction prices have gradually increased. The price of SAMSUNG DDR3 4Gb has risen from a low of around US$1.28 to around US$1.4, and the price of DDR3 2Gb has risen from around US$0.91 to around US$1.0. The short-term increase is the largest and most lacking should be HYNIX DDR3 4Gb 512*8 EFR-RDC The price of this one is reported to be around US$1.7, and there are few orders. But for the memory trend after the 15th, the market spot merchants also expressed concern, so everyone will want to sell their inventory at a high price to reduce the risk near the 15th. In mid-to-early August, the price of 4Gb DDR3 fell below the historical lowest price. The lowest price was around US$1.25, but the low price only lasted for a week or two. The price rose to around US$1.35 in mid-to-late August. There is a relatively large demand for sourcing, which has caused the price to close to US$1.40; the price of 2Gb DDR3 has also increased by a few cents. DDR3 general materials: MT41K512M8DA-107:P, MT41K256M16TW-107IT:P, MT41K128M16JT-125 IT:K these are in stock by our company, please inquire for details. In South Asia, the original factory distribution decreased this month, and the market price has increased from the previous month. Although the supply side is insufficient, it is foreseeable that demand will remain weak in the second half of the month.

Nand Flash

Recently, Samsung and Hynix have less demand for small-capacity flash memory, and their target prices are much lower, resulting in very limited transaction volume. For Micron, the prices of some part numbers have been adjusted, and customers with long-term needs can inquire in detail. Whether it is Kioxia or Macronix, the price remains stable this month. The demand for Nand Flash is still very small this year, and the price is already low. It is expected that this situation will continue for a long time. The price of Winbond’s Nand Flash is relatively stable, but the current spot is relatively small, so you need to look at the part number to order.

Nor Flash

The price of large-capacity Nor Flash Micron is relatively stable and has a price advantage compared to other brands. Cypress's shortage caused the recent delivery delay, but it has not seen many out-of-stock demand outbreaks. Macronix is still stable, some partial models that were out of stock have also eased, and the overall price is relatively stable. Winbond’s Nor Flash has rebounded slightly in price since late August, and the spot is very small. The original factory has a slight shortage of supply. The current delivery time of 32Mb, 64Mb, and128Mb is expected to be about 4 weeks.

EMMC

The price of EMMC should fluctuate relatively steadily recently. The price of EMMC 8GB has remained low at around US$1.8 for almost February, and the price has been fluctuating around US$1.8-US$1.9. Recently, it has also rebounded from the low of US$1.8 at the end of August to a quotation of around US$1.9. However, the transaction volume is limited. Market customers and end customers are not willing to buy goods at high prices. They are still in a wait-and-see state and their buying actions are relatively conservative. Recently, EMMC 4Gb has a lot of inquiries and orders, and the channel vendors' quotations are all around US$1.7, but the transaction price is hardly higher than US$1.68. Since EMMC's original production capacity is still in normal supply, the inventory is relatively sufficient, and it may still be in a state of oversupply. It is recommended that you can wait and see first, and do not chase high stocks for the time being. Due to the replacement of new and old models of Kioxia, the prices of some discontinued models have risen slightly recently and are slightly out of stock. The demand and price of general models are not expected to fluctuate much this year.

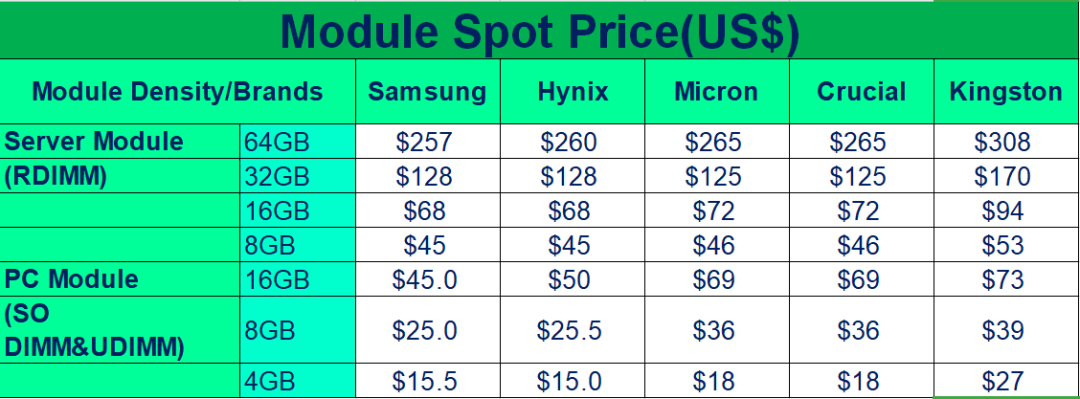

Memory Module

Recently, due to the Hong Kong epidemic, many cargo declarations have been affected, resulting in restricted cargo transportation, making it difficult to declare and pull in goods. This has resulted in a situation in which the stocks of spot merchants in the market are limited, or even no goods can be shipped. Recently, market inquiry demand has rebounded, PC and notebook prices have risen slightly, and transaction volume has also improved. The current price of a 16GB notebook is around US$51,and the price of an 8GB notebook is around US$26. Server memory is still relatively deserted recently. The price of 32GB fluctuates around US$120-US$125, and the price of 16GB fluctuates around US$67-70. Although the end customer has some order demand, but the target price is low, because it is not urgently needed, it is also in a wait-and-see situation. For Micron, our company has a MTA36ASF4G72PZ-2G6E1, MTA4ATF51264AZ-2G6E1 in stock, and the price is beautiful. Please inquire for details.

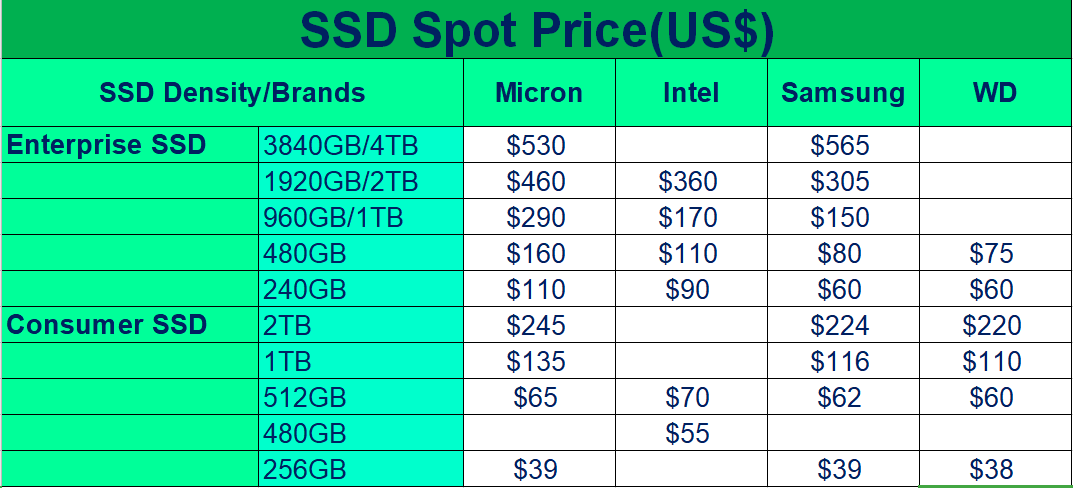

SSD

The price of consumer-grade SSD has risen slightly recently, and the demand for purchases by spot merchants in the market has risen, but the target price is still slightly deviated. Since the spot inventory of the PM981a solid-state drive series is limited now, channel vendors are unwilling to lower the price for shipment, and the final transaction price has risen slightly. The demand for enterprise SSDs is still sluggish. Suppliers continue to sell their backlogs, but there are few inquiries for purchases by clients, resulting in very slow inventory consumption. For Micron, the enterprise-level 240GB price has no price advantage compared to Samsung/Intel. The price of 480GB/960GB A is negotiable. Please inquire for details. For consumer-grade solid-state hard drives, Micron’s price does not have a significant price advantage. However, Micron has better quality assurance, and there will still be customers who are willing to use only Micron part numbers.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

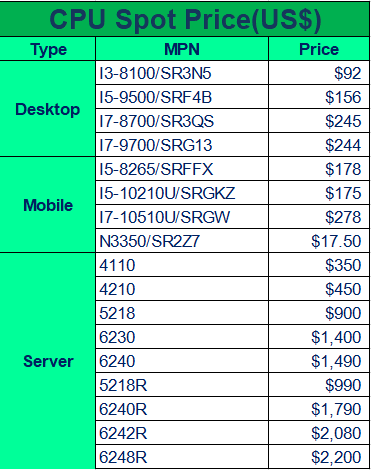

As we approaches Q4 of 2020, CPU have shown more activity from market , include XEO Nand DT , demand start show now mainly for Server CPU , DT still face weak demand . XEON CPU price have move up but this is only the price start to return to normal level , market stock have going fast , and we forecast demand will keep move up with time goes by to end of 2020 .CPU have back to be a active and key trading product .

INTEL Notebook and Tablet , mainstream 10 generation ,demand of I5-10210U andI7-10510U have stopped seems , market price have droop , 10210U price US$173,10510U do not have big quantity offer ,but price have drop a little to US$278, the hot parts will be I5-1035G1 ,and I7-10875H , both face hug shortage ,hard to get parts even small quantity . low end Mobile CPU like N4000 ,N4100,N3350 price kept at high level , and demand still good,

DT market , low price parts have cleaned ,and price start to return to normal level , but INTEL demand still weak , AMD show more active from market , and more and more brokers start to deal AMD DT CPU now ,

Server market , demand back a lot ,recent 2 weeks Server market especially INTEL XEON market have more activity ,price move up ,but still lower than INTEL normal level , like 6240 the lowest show US$1380 ,and now back to US$1490 , but INTEL normal price is US$1700+, but stock keeper have sold out most of their stock and start to booking new supply , we forecast Q4 will be a good time to deal CPU , as demand is good and no idea INTEL supply will good or not, also INTEL like to announce new generation XEON CPU on the begging of 2021 ,we will see INTEL‘s capability of production , if INTEL supply face trouble again ,XEON market will be a good market.

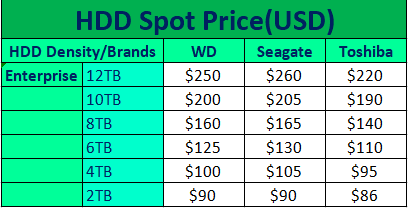

HDD

HDD

The overall shipment volume of HDD last month is quite impressive. Enterprise-class large-capacity HDD are slightly out of stock on some models. For example, for the enterprise-class10TB and 12TB, the delivery period has been extended to 6-8 weeks. The original supply of other models is still quite sufficient, and you can communicate more if you need it.

In terms of prices, WD and Seagate have both significantly reduced. On the one hand, the fierce price competition of various large and small-brand solid state drives affects the price of mechanical hard drives; on the other hand, due to the impact of the epidemic this year, major domestic and foreign factories are under tremendous pressure on profitability. All demanded price reductions. This has to make mechanical hard disk manufacturers adjust prices again. The following is a price reference, we will always pay attention to price changes.

As far as the overall situation is concerned, the overall demand for TI in August was not strong. Although it seems that it is still caused by the impact of the epidemic, I personally think that TI's direct sales model will at least have an impact on the spot market. The reasons are as follows:

1.The only supply channel. This leads to anomalies in the supply of the overall spot market, including the failure of special prices due to the customer’s direct supply from the original factory; the number of shipments is directly reported to the original factory, etc., which will affect the supply of goods to the spot market.

2.Vigorous promotion of alternative brands. The MPS mentioned before, 3PEAK. It is reported that MPS has been replaced by MPS in many clients, especially leading companies with a state-owned background, and many TI power management ICs.

I have received news that TI’s small-size wafers are currently in short supply. I hope this news can bring some good news to the tepid spot market.

Since the acquisition of American trust by ADI, the Chinese government has not approved the acquisition, so far, there is no special action. At present, there are still many special prices that have not been restored, and our traders and professional Mercure spot merchants have also been greatly affected,

Last month, the market of American letter was still stable, the spot inquiry increased relatively, and the real and effective demand also increased. The market situation is relatively stable, and the cooperation degree of agents is also very high. Many long-term demands can re apply for more advantageous prices.

Compared with the same type of brands, the delivery time and channel of Maxim are relatively stable.In addition to seizing the shortage demand, some stable long-term demand is also worth exploring.

1.Due to COVID-19 and insufficient raw materials, the lead time of some NXP product lines became longer. For example, the standard lead time of MCU has been extended to 18-20weeks, or even worse, the pressure sensor which be made for the ventilators and other related epidemic prevention equipment. Lead time extended to 30 weeks+;

2. As the pressure sensor which is used as an anti-epidemic material for ventilator products, it is in short supply. At present, the open orders are far greater than the NXP’s schedule, and the market spot price is very high. Quiksol has MPXV5004GC6U in stock now, welcome to inquire for sensor requirements;

3. Due to the accumulation of anti-epidemic materials take in a large part of NXP's production capacity has also caused other series of shortages, such as the MPU-MPC5200CVR400B which be used in the automotive field, that has been under allocation since April this year till now. It is expected that this statue will continue till the end of the year. Quiksol can get some allocation in every 1-2 weeks, please contact Quiksol if you have this demand, we can proceed booking order to NXP and then keep allocate it, but the lead time we have to offer 18 weeks now.

Affected by the international situation, Infineon has a large amount of demand out flow, especially for MOS tubes. However, the overall price and delivery trend is fairly stable.

For the IR3XXXMTRPBFseries that received much attention in the first half of the year, the original supply can gradually cover demand, and the price continues to decline. Although individual models are still high, the overall market is not as hot as the first half. The prices of some models have gradually become normal. However, due to demand and process issues, individual models are still in short supply, and we can continue to pay attention to the market opportunities of the IR3 series.

The impact of the10-20% increase in the price of raw material on the price of Infineon needs to continue to be paid attention to in the follow-up. We still need to pay more attention to spot demand and validity of long-term quotation.

We have BSC040N10NS5 for long term supply. Please contact our company if you have any requirements, thank you.

1.The prices of incoming stock have been increased since April while Altera announced price adjustment in March, affected MPN such as : EPM570T144I5N,EPM1270T144I5N, etc.; on the other hand, the stock demand increased suddenly due to impact of Covid 19, such as EP4CE22E22C8N which is used for mask machine coding, and insufficient production capacity caused multiple ticket skips in June and July.

2.Compared with the short supply in the passed half year, the overall market demand has declined since August to September. It is easy to pull in open order and the delivery time is relatively stable now.

As one of the world's top 10 semiconductor chip suppliers, Renesas has achieved the highest global market share in many areas such as mobile communications, automotive electronics and PC/AV. In particular, has focused more on the automotive market through acquisitions and consolidation. With the arrival of Q4, the traditional peak season, the terminal increment situation is obvious, and the Renesas factory is basically over worked. For orders placed since August, the MCU delivery date has been scheduled to 2021.As the epidemic situation in the United States has not yet eased, American residents work at home and have a great demand for PC market, so the capacity of Intersil original factory is basically limited to supply American companies. At present, the delivery period of Intersil is basically more than 24 weeks. At the end of August, WPI canceled the agency privileges and WT will take over. There will be some Intersil shortages, which is also a good opportunity for the market, such as ISL95855,ISL6262, ISL6545.

About the 5G industry chain, Its applications, Operators, Terminal. Upstream mold level, Devices, Chip, And more upstream material, It involves a very wide industrial chain, Very long, And on the 5 G RF front-end development and trends, In the future will be the focus of attention of manufacturers. RF front-end modules mainly include: filter, power amplifier (PA), Low noise amplifier, Radio frequency antenna, RF switches, antenna tuners, Duplexer, as well as receiving, transmitter and other parts. And in G new 5 applications, Duplexer, The application of filtering is more used, For the original 4 G, Basic filtering costs $4~6, And in five G, the transmission of stronger signals and speeds, The loading cost of filtering increases to about $10, The demand for filtering products, TDK as its main supplier, A significant share of market share.

1.intelligent loudspeaker: duplex / DPX105950DT-6012A1&DPX105850DT-6019A1,patch antenna: ANT016008L system and ANT161575 system, as well as high frequency induct or MLG &MHQ0603 series products shipment and demand increase.

2.Load Class Inductance: VLS3015/VLS6045/VLS5045, and SMP Series with Current Supply Stressed.

3.TDK acquisition of brand Inven Sense development of the first 7-axis inertial air pressure sensor; ICM-20789 mainly used for UAV air frame control and location and navigation, continuous attention.

ST’s shortage phenomenon has lasted for nearly two months in the spot market, and there is no sign of alleviating it. This makes me worry about traders who specialize in spot business, because the original factory shipments have decreased, the delivery period has been extended, and the goods on the market are slowly being consumed. Although it is a seller's market, if there is no stock to sell, this initiative is obviously not pleasing. STM32F030C8T6 is regarded as one of the hottest and most short-supplied material in this month. The price has also risen from 0.5 US dollars to 0.7 US dollars, but the spot is also like a rainbow after the rain-sometimes it shows and sometimes not.

In fact, most of the time what we talk about ST MCUs refers to the mainstream MCUs of STM32, F0, F1, F3, etc., because these material numbers are the most common and there are bought and sold by most people in the market, so the natural spot market revolves around mainstream MCUs. But in fact, ST's MCU also includes the H-high-performance series, MP-MPU series, L-low-power series, and the W-wireless series that has recently been vigorously promoted. With the advent of the Internet of Things era, more low-power and high-performance products will set foot on the mainstream MCU stage. Stay tuned!

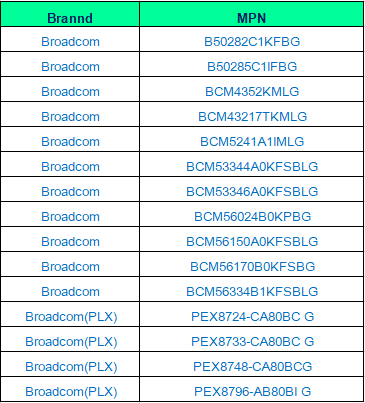

1. Defeated by one big OEM’s demand from August to early September, experienced a large-scale short-term out-of-stock. Almost all of the three major agency stocks were requisitioned by one big OEM. The main series involved are BCM56series and BCM88 series and some PHYs, such as BCM56870A0KFSBG,BCM56760B0KFSBG, BCM56850A2KFSBLG, BCM88770A1KFSBG, etc.

2. From April to now, the demand from operators has been increasing, leading to continuous shortages of WiFi chips and PON chips, resulting in rising prices. For example, the price of BCM43217TKMLG has increased by more than 100% from March, and BCM68380IFSBG has increased more than 200% from April. It is observed that the out-of-stock status will continue until the end of 2020, so in the second half of the year, we can focus on the demand for WiFi (BCM43XX)and PON (BCM68XX)

3. In terms of delivery time, it is still maintained at about 26 weeks. Some discontinued items that are in short supply may require a longer delivery time. Under this long delivery time, coupled with one big OEM's current sweeping of goods, had a serious impact on SMEs

3. Here are our on-hand stock and parts with competitive pricing:

Qualcomm's Q3 has extended the delivery time of the full range of Voice and Music products(such as CSR/QCC/QCA/AR series) from the original 12-14W to 22-24W.And the client FCST material shortage led to the recent serious shortage, demand exceeds supply.

Ethernet chips used in enterprise switches, mobile base stations, optical modules and other equipment demand increased this month, the price trend is obvious, such as QCA9531-BL3A need high prices and other original factory goods.

In addition, the current market price of BLUETOOTH chip CSR8670/CSR8675, which is applied in TWS field, has risen to US$6.5- US$7, which is still hard to one big OEM obtain. It is expected that there will be some relief at the end of Q4.QUIKSOL has a good order channel and supply, welcome to exchange.

1.In August, the Microchip market was relatively flat and the overall demand was not high. However, what was particularly obvious in August was the impact of the extended delivery time on the market and the client. The letter of Microchip, which starts on 2020.8.1, strictly follows the 16-20 week delivery period of the standard product production cycle, and does not accept the urgent request. So the market feedback information in August is more: urge + urge. It is suggested to reserve more order delivery time in the following quotation.

2. Recent market hotspots: LAN series, KSZ series, Ethernet chip, applied in network and video. This is related to tight communications customer demand. For example, KSZ9031RNXCAmaterial, the demand was once relatively prosperous, the market side is out of stock, the client side is short of material, supply is tight, later eased. In September and October, we can still focus more on Ethernet chip requirements.

3. Our company has along-term demand for microchips. If you have a superior channel and material number, please contact us for negotiation.

In the coming third quarter, Lattice's market demand is relatively flat, The main reason is that the market share of the brand itself is not large, However, in terms of supply, due to the continuous impact of the epidemic and the Sino US trade war, the delivery time of Lattice products is still not good, Market prices have also risen. In terms of products, low-end CPLD such as MXO, MXO2, MXO3, isp4000 and ice4000 series with low power consumption and small size are the mainstream of factory demand, For example, LCMXO2-4000HC-4FTGI, LC4128V-75TN100C, LCMXO2-4000HC-4BG256I,LCMXO3L-9400E-5BG256I were out of stock, These products are widely used in industrial control and security field. In the field of general FPGA, XP2 series is out of stock, especially for products below 10kluts, such asLFXP2-8E-5TN144I and LFXP2-5E-5TN144I, In addition, the Cross Link-NX series, which is mainly used for embedded visual processing, is a new product pushed by Lattice, such as LIFCL-17 and LIFCL-40, However, this kind of product agent support is relatively poor, the market circulation is very few. In the coming traditional peak season, manufacturers with corresponding demand can make stock preparation plan in advance to avoid stock shortage.

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat