Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands:Micron, Samsung, Hynix,CPU, HDD

Overview:

In the past month, memory prices have generally shown an upward trend. The foundry production capacity is tight, the packaging and testing capacity is tight, Hynix has given up the supply of DDR3 2Gb, the continuous shortage of active ICs has increased prices, and the delivery period has been lengthened. All these can be described as the attribution of price increases from the supply side. However, the most important reason for the price increase came from the demand side. It is said that Taiwan received a six Million communication order, which caused the DDR3 4Gb, which was already under-stocked in the market, to be swept away. The price rose to more than US$1.50 in the last two weeks. , I don’t know if demand is cooling down with the weather, and prices have dropped slightly this week. People in the industry are generally bullish on the 2021 market. Regardless of whether it goes up or down, the business of memory is negotiated. It is still necessary to communicate more with customers and suppliers.

GDDR5:GDDR5 was originally used in mining rigs. As early as 2017, when the Bitcoin blaze, the demand for GDDR5 was very large. Later, as the demand for mining machines fell, the price also dropped. GDDR5 8Gb was basically at US$5.00. At the same time, graphics cards Demand has risen significantly; since this summer, GDDR5 has continued to be out of stock. Almost all GDDR5 8Gb memory products are hard to find. The original factory gives priority to supplying the needs of large customers. This has caused some small and medium customers to keep adjusting the spot outside. When the goods were released, they were quickly robbed and the price was increased by nearly 50%. The current price is in a serious bubble, and it is reported that the shortage will continue until the end of the year. Part of the part number requirements for this type of GDDR5 have been transferred to GDDR6, and GDDR6 is the main product of the original factory in the future. GDDR5 must be carefully prepared.

LPDDR4: Recently, LPDDR4 is also very out of stock. 4Gb, 8Gb, 16Gb are very few in stock, especially for automotive LPDDR4. With the full coverage of 5G networks, intelligent driving systems will become a hot spot in the future. At present, Micron is considered to be the most long-term and mature brand in the automotive market among the three major players in memory. Coupled with the requirement for long-term and stable supply of vehicle specifications, this is also in line with Micron's consistent product support principle for customers.

DDR4

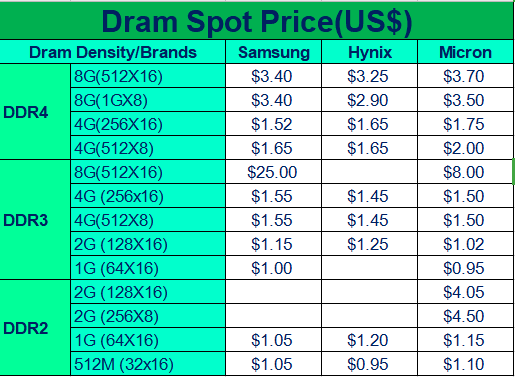

As for Micron, the Z11B series continues to be out of stock, and prices have risen slightly. It is expected that the stock out will continue into the first quarter of next year. For Samsung, the 18NM 8Gb WC-BCTD is relatively out of stock, and the price has risen slightly. The current price is around US$3.4-3.45. The price of HYNIX DDR4 8Gb has recently dropped somewhat. At around US$3.2, the price of DDR4 4Gb is relatively stable. It is said that both HYNIX and SAMSUNG will increase their prices from next month, and the response may be more obvious in Q1 next year. It is recommended that customers with actual needs can prepare some inventory appropriately.

DDR3

As for Micron, DDR3 4Gb has been adjusted downwards after a slight increase. The price of DDR3 2Gb, which was originally the cheapest in the market, has also increased. The supply of these two is tight, and they are the two material numbers that are mainly used on WIFI6. In the future, the price should not have a big drop. On the contrary, the price may continue to increase. Customers in need can properly prepare some spot inventory. The Samsung DDR3 4Gb and 2Gb BYMA models are in short supply, the shortage is more serious, and the price is relatively high. The BCNB model is relatively abundant and the price is relatively low because the recent TV shipments are not ideal. Similarly, Nanya DDR3 2Gb is also in short supply, and the original factory currently concentrates its production capacity to supply major customers.

Nand Flash

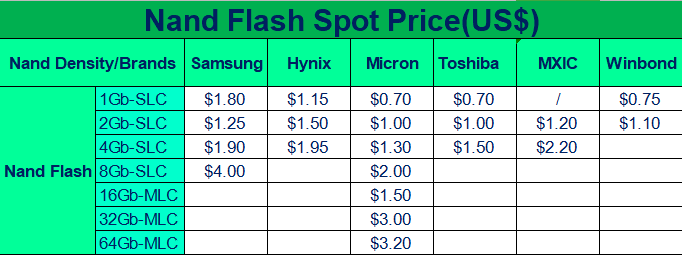

The most out of stock in the near future is 1Gb SLC Nand flash, and the price increase is also the largest. Macronix, Winbond, GD Innovation, this capacity has been out of stock, the current demand is huge, and there is no possibility of short-term relief. There is no price fluctuation for other capacities for the time being, and there is no impact for the time being. winbond Nand flash is also in shortage, W25N01GVZEIG the normal price is US$0.60, but now the booking price is upto US$0.70+ and the lead time is longer than 8weeks.

Nor Flash

At present, 16-64M capacity is seriously out of stock, and market prices have risen significantly. Macronix and Winbond expect the shortage will continue into the first half of next year. As time goes by, high-capacity delivery may gradually be affected. In the long run, the demand on the application side will gradually increase, and we are optimistic about this market in the long run. Winbond Nor flash still in shortage, especially for 16M, 32M, 64M,128M and the price is raising up.

EMMC

After the National Day of EMMC, due to insufficient arrivals and more inquiries, the price has risen, but recently due to unsatisfactory demand, the number of original factory arrivals has increased, resulting in a wave of decline in the market, and EMMC 8GB is currently falling To around US$1.9, the price of 4GB is relatively stable at around US$1.65, 16GB is around US$2.9, and 32GB is around US$5.05. Compared with DRAM, EMMC has sufficient production capacity, so the later supply will be relatively stable, and it can be purchased according to actual demand.

Memory Module

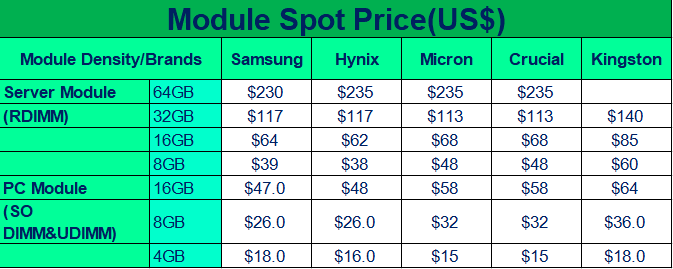

Recently, the demand for memory modules is generally not ideal. In particular, the recent poor demand for servers has caused the price of server-related memory modules to continue to fall. Samsung memory modules have recently been out of stock for the C version, and the new version of the D generation 16NM is also relatively expensive. Inexpensive, it is recommended that the client can verify the new version in advance to prepare for the later. In addition, the recent demand for PC and notebook memory sticks is not ideal, and the price is relatively stable and has not changed much. Our company has the following two memory modules in inventory. Server memory modules are 32GB: MTA36ASF4G72PZ-2G6E1 100pcs; PC memory modules 4GB MTA4ATF51264AZ-2G6E1 700pcs; the price is favorable, please inquire in detail.

SSD

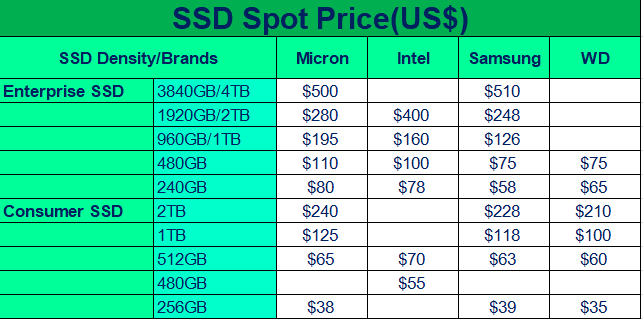

The price of enterprise SSDs has continued to fall recently, especially large-capacity SSDs. The prices of small-capacity 240GB and 480GB are relatively stable. However, due to the high inventory pressure in the upstream, if there is actual large demand, I believe we can talk about an ideal price . The prices of consumer-grade SSD PM981a and PM981 have fallen slightly recently, and the supply quantity has been slightly looser than before. However, the market and client demand have weakened, making it difficult to reach the previous high prices.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

1. INTEL Notebook, keep the situation of SHORTAGE , but we can see some better price offer of 10 generation , like I5-10210U, price US$176 , I7-10510U, price US$255 , I5-1035G1 price have some drop from US$193 to US$186 , that means INTEL supply turn better , but such situation will change very soon , low end N4000 ,N4100, N3350 ,still very short , price is high , N4000 US$27 ,N3350 US$28 and no stock offer ,but booking with 3-4 weeks . AMD recently market price was moving up very soon, 3700U price from US$175 move up to US$185 , 3500U no supply , and the mainstream 4000 serials face tight supply , we forecast the shortage will kept to Q1 of 2021 . we still need focus on this market .

2. DT market , whole market is active, price moving up . and some model face shortage also , like I3-8100 price move up from US$90+ to US$120 , G5400 price now is US$60 around , very high , but customer still have demand and want to buy , for other key model ,price also turned higher than before, I5-9400 US$148 ,I7-9700 US$216 , main reason is FD and some key brokers do not booking parts from INTEL as they have lost too much money in mid of 2020, they only will have new booking from INTEL after they have cleared their on hand stock , that case the market supply is not stable ,and supply turned tight when demand came. But we see demand of DT in whole year of 2020 is not good , the main growth is from Mobile market.

3. Server market , demand is good , but the real demand is not good as we expected, so the market price still just return the normal , like 4210 keep the price US$350 , 6230 price US$1380 , 5220R price is stable at US$1230 .

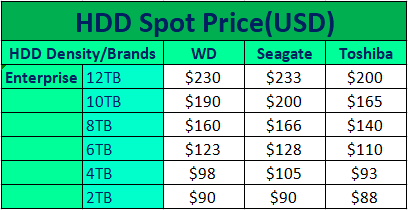

HDD

HDD

It has reached Q4 in 2020. Compared with Q3, the overall demand for HDD has increased slightly, and most of the OEM customers are preparing to keep stock. In general, the market is relatively active. In the following month, I believe there will be more demand.

It can be seen from the market that in November, the shipments of 12TBand 16TB are still relatively considerable, and the price also drops slightly. Now the price of 12T is around US$230, and the market price of 16TB is US$335. Quiksol has special price of this 16TB part---WUH721816ALE6L4, you can talk in detail if there is a demand!

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat