Since the beginning of the epidemic, various brands have been out of stock. From ADI, NXP, ST to Richtek, Realtek. Everyone's topics have always revolved around out of stock, price increases, delay and extended delivery time. Until the end of October, the AKM factory caught fire, and the shortage wave climbed to a new peak. In the past month, AKM is hard to find, ST has eased, NXP continues to be hot

After the big shortage, what is the current situation of each brand? IC buyers in Quiksol have sorted out the analysis and summary of several brands for you, and there is always one that will interest you.

On October 30, AKM officially announced that it is very difficult for the fire plant to resumeat present, and it is expected that Q4 will not be scheduled until next year. Currently, it is seeking external OEM partners. As an audio IC giant, AKM's severe fire means supply is cut off. The scarcity of AKM is magnified by its small market niche and small market liquidity. AKM is also difficult to supply in the spot market in a short time. At present, AKM product line is almost all on the rise, ranging from several times to dozens of times. Take ak4452VN-L asan example. Previously, the normal price of this type of chip was about ¥8, but the current increase is between 60-80 times, which is still hard to find.

From the perspective of product classification, ADC (analog to digital converter, namely A/D converter) audio application products are mainly used, such as AK5720VT-E2, AK4452VN-L, AK5578EN, etc. The short-term supply shortage caused by fire is difficult to replace; Fewer agents and distributors; The soaring demand is an important factor in the price rise of AKM. In general, AKM shortage price has become a certainty, the subsequent supply situation depends on AKM OEM supplementary capacity and the emergence of stable replacement products.

Since STM entered November, the price increase momentum has been curbed. The prices of 103,030 series have all been fine-tuned. STM32F030C8T6 has fallen below US$2, and the market interest has gradually been replaced by AKM. However, there is as aying that the original factory shipments in December may still be relatively small, so there may be another demand in December. Please seize the opportunity.

STM's production capacity problem has not been alleviated. The delivery time is still around 16-20 weeks. The price quota for major customers is almost exhausted, indicating that the delivery time cannot be returned to the past within a short time.

Due to this wave of STM shortages lasting for a long time, factories are looking for alternatives. Domestic MCUs replace brands such as GD and CHIPSEA has been really hot recently, . Big data platforms looking for alternative material numbers have also begun to flourish. I hope that domestic chips can do better in the semiconductor industry.

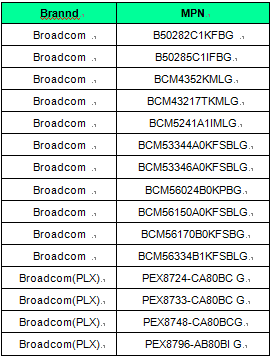

Like other IC brands, Broadcom is in the line of price increasing, short of supply, and lead time extension. The shortage will continue. If it goes bad, it will be out of stock for the whole year next year. The most shortage models are BCM56842, BCM56846, BCM56860, BCM82792, BCM82381, etc., and some PLX series, PEX8748, PEX8749, etc.

In the nearly future, Broadcom’s factory will once again increase the price of some materials globally. The price increasing is expected to be extra 10 to 15 percents. The main reason is that the price of OSAT and raw materials has increased, and some of the items that do not increase in price would have increase in MOQ. What used to be only one package has now been changed to 6 packages or even more than 10 packages. Therefore, it is recommended that if you have the incoming goods, you'd better take in the goods as soon as possible.

Broadcom has recently been witnessed a large number of refurbished steel products in the market, such as the familiar BCM56 series and BCM88 series, most of which are steel surfaces, such as BCM56846, BCM56860,BCM56960, etc.

Here are our on-hand stock and parts with competitive pricing:

Because lack of wafer and produce capability, the lead time extend to 20 weeks+ now. There should pay attention to the shipment schedule now as there is always delaying the shipment date.

Automobile materials are in short supply;

The supply of NFC chips continues to be tight. The most popular NQ310/NQ330 are currently in short supply. At the same time, the replacement material PN553/PN80T cannot be supplied too, and the situation is not optimistic;

It is expected that this wave of shortages will continue until Q2 of 2021.. It is recommended

that can book parts if you have demand earlier now.

Describe the situation of realtek this month as a whole: price increase and shortage.

This month, the shortage of realtek became more obvious, and the visible supply became less. Excluding the ALC662, the shortage of many network card chips and switch chips is increasingly enquiry from the customer. The delivery delay have made the goods on the market tense, and price doubling has become a common material phenomenon.

The material order lead time has been extended beyond March next year. The market price changes every day in an upward trend.

Market conditions are forced to require customer to make order decisions faster. Compared to long-term orders, now is a better time to make shortages order.

The overall supply of Renesas has been tight since the beginning of the year, lots of delays happened. Meanwhile the delivery time is at least 16-20 weeks (some materials are scheduled to 30 weeks). The current shortage trend will continue until Q1 2021; New orders are scheduled at early of 2021 which we placed on October, such as 9FG104EGILFT and so on. The demand increased for network communication equipment such as switches and mobile base stations, for example: 89H12NT12G2ZCHLG, 89HT0832PZCBLG8, ISL6617AFRZ-T, welcome to contact QUIKSOL if have any demand.

Tantalum capacitor market, Still out of stock, The main reason is the plant's lack of capacity, In the first three quarters, New energy, Increased demand for vehicle-related products, The delivery period was renewed, Conventional A, B 105 106 107.226 UF, 16V 35V, 25V and other material shortages, With the price rising, T521, TPSE 2971,7343 and other special low ESR resistance, high polymer capacitance, More in demand, There placement brand KEMEET and AVX/VISHAY delivery date have exceeded to 20 Weeks, High reliability of tantalum capacitors, With ceramic capacitors, aluminum electrolytic capacitors, film capacitors irreplaceable unique advantages, In the high-end capacitor market, Especially in the field of military industry, market share is relatively stable. In the future, due to the failure to improve the delivery period, Lack of material is inevitable, be more attention.

Since the middle of October, the demand of microchip has increased compared with the previous months. This has a great deal to do with the prolongation of microchip delivery time. It is understood that the delivery time of some models of Microchip has been extended to more than 26 weeks, including Atmel and MGM. The delivery time is very long, so the market is in short supply, resulting in the shortage of goods. For example, the demand of LE9641 and LE9643 plants of Microchip has increased, but the original factory delivery period has been extended, and the gap is still large.

It is reported that the original factory only accepts the right to pull in after 12 weeks for the order materials, that is, it can only be pulled in after 12 weeks, otherwise an additional fee of 10,000 to 50,000 will be charged. Therefore, there are various signs that the microchip is out of stock, and for the long-term demand of the factory, the order should be arranged as soon as possible.

Our company has a long-term demand for microchips. If you have a superior channel and material number, please contact us for negotiation.

Since November, TI supply has become more and more obvious, not only because of the shortage of small wafers, but also related to the last quarter of the agent to abandon shipments. Some materials have been in a very short state, such as TPS63070RNMR, the original price of a few cents, has now reached about four dollars. The price of TI is still unstable this year, and the delivery date will be gradually extended. If you have stable demand for some material Numbers, you might as well get the goods ready in time.

Recently, with the booming IC market, the demand for ADI is relatively small, and a large number of materials that have been out of stock for a long time have also arrived in large quantities. The price of ADM2587 has gradually returned to the normal level. After rising to above US$7, ADM3053 has dived to about US$4. The market has been fighting a price war.

However, some general materials are still in short supply, the delivery of REF195GSZ is expected to ease, but price is still more expensive than book price in the market; the market price of adum1201arz is still at US $0.7.

Although there is less demand for ADI recently and the market competition is fierce, it will take some time for the supply-demand relationship to return to balance. Even if the market is fighting a price war, the overall price is still on the high side. We can try more channels of franchises and original factories to get better support.

In the fourth quarter, the market demand of Onsemi was still strong, The main reason for this is the wafer shortage that has continued from the first half of the year to now and is still in momentum. Among them, the shortage of 8-inch wafer and rising price have the greatest impact on Onsemi ,Because the main demand side of 8-inch wafer basically covers all product lines of Onsemi ,Such as power devices, power management IC, image sensor, driver IC, especially MOSFET in power devices ,Because of its low technology and huge demand, its production mainly depends on 8-inch wafer ,as a result, MOSFET is out of stock and its price rises ,coupled with the arrival of the fourth quarter of the traditional peak season, the demand for automotive electronics and consumer electronics has increased greatly ,as a result, the shortage of power devices and power management IC increased, and the delivery time generally increased to more than 20 weeks ,At the end of October, Onsemi announced its third quarter results ,revenue was down from the second quarter and the same period last year ,for these effects, we do not know whether Onsemi will adjust the price of its products in the future ,but shortage will still become the main theme of the market.

Nowadays, the shortage is not just a matter of a certain field, from the wafer to the production capacity and testing plant, and even the raw materials for the packaging and testing. The impact is not limited to the big brands, the delivery period of all kinds of small original factories is also increasing. Christmas and Chinese New Year are coming, this is the traditional peak season, we need to Seize the opportunity and meet the challenge.

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat