Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands:Micron, Samsung, Hynix,CPU, HDD

Overview: Memory market price increases, shortages, Hynix shutdown, Micron power outage, these keywords have made many people in the industry feel puzzled about this wave of rising. Is the original factory out of stock, or artificial speculation, or is the terminal demand good to a new height? Looking back at this year’s memory market, although the COVID-19 took the lead at the beginning of the year, this year is not that bad. Distance education, data centers, Internet of Things, video games, 5G base stations, consumer markets, etc. are all better than we expected. In addition, the COVID-19 has made everyone relatively conservative in predicting market conditions. Orders have been reduced compared to the same period in previous years. When demand suddenly increased, many original factories were insufficiently stocked and spot inventory was rapidly digested. This is an important factor in price increases. Recently, major memory manufacturers and IC chip manufacturers have raised their prices. Everyone said they are optimistic about the market next year, including Samsung. Hynix also predicts that the market will be in short supply next year and is preparing to expand production capacity to meet next year's demand.

The reasons for the actual shortage are as follows: First, the raw material for wafers is very out of stock. It is reported that there are still some wafer supplies for the biggest three memory factories. Other brands such as Nanya have almost no wafer supply. The future situation is not optimistic; Second, Micron’s original 1X manufacturing was converted to 1α manufacturing, and Samsung and Hynix are also switching to new manufacturing. In the process of switching manufacturing, it is inevitable that there will be a higher defect rate. The process needs to be improved, which will affect other maturity Third, the demand for notebooks and tablets has surged due to distance education/office. The mobile phone market started in the third quarter of this year. Part of the original factory's production capacity was occupied by mobile phone materials, which also affected the production capacity of other materials.

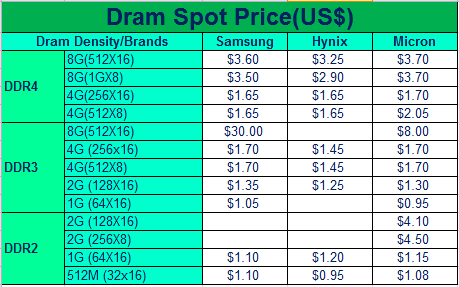

DDR4

Recently, DDR4 is out of stock, especially in the 18nm part. It is obvious that the terminal is looking for goods. Due to the lack of stock in the market, it is difficult to meet the large spot demand of customers. This has caused the price to rise significantly recently. The price of Samsung 8Gb WC-BCTD is US$3.65 Around, the price of 4Gb WF-BCTD is around US$1.70. The price of Hynix DDR4 8Gb has also increased a lot. The price of 8Gb CJR-VKC is around US$3.60, and the price of 4Gb BJR-VKC is around US$1.65. As of today, Samsung’s price this month has not been released. It is said that Samsung will raise the price, so many people are also waiting for the new price. Micron's Z11B series DDR4 continues to be out of stock. For the demand in the next three months, please make sure to arrange the order early and distribute the goods. It is reported that the current order delivery date has been scheduled to March next year.

DDR3

Every time a price increase comes, DDR3 is always the product with the largest increase. Recently, DDR3 2Gb is out of stock. Perhaps due to the discontinuation of HYNIX, Samsung DDR3 2Gb has seen a huge increase recently, and the demand for goods is also very large. Samsung 4Gb and 2Gb BYMA This model is still in short supply and the price is relatively high. The market price of 4Gb is reported to be around US$1.80, and the price of 2Gb is reported to be around US$1.40. BCNB is relatively abundant. The market price of 4Gb is reported to be around US$1.70, and the price of 2Gb is reported to around US$1.30. For the rapid price increase of DDR3 this time, many people also feel that the hype is strong. Although end customers have demand for inquiries, they cannot accept such high market prices, and most customers are still waiting and watching. Micron’s DDR3 part shipments are relatively small, and as the market price rises for commercial grades, the industry is generally optimistic about the market next year. For Nanya, prices have risen sharply. 2Gb is very out of stock, and 4Gb prices have skyrocketed. I would advise customers to cherish suppliers who can still supply them.

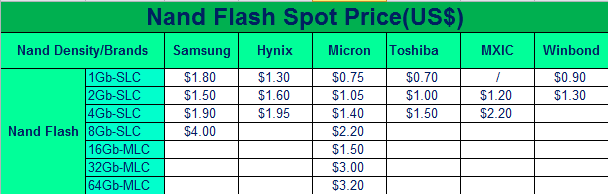

Nand Flash

Micron’s 2Gb SLC and G version are out of stock recently. There is a large gap in customer demand and the original factory shipments are small. There is demand in the next three months. Customers are advised to place a stocking order early. The current order has been scheduled until February next year. . Macronix and Winbond’s 1Gb model is still out of stock, MX35LF1GE4AB-Z4I/W25N01GVZEIG Macronix is expected to be rarely available from the original factory. Customers are advised to replace the model as soon as possible. Winbond’s original factory is out of stock and the delivery period is extended. , Customers in need place an order as soon as possible. The price of Winbond has risen from US$0.70 to the current US$0.85 or even higher. Customer demand is also increasing. The original factory supply is insufficient, and the distribution of goods by agents is very small. This is expected to be out of stock in a short time.

Nor Flash

Recently, the small-capacity domestically produced Nor flash of less than 128Mb is very out of stock, which makes it relatively easy to ship some of Micron’s old low-capacity inventory with D/C. If you have sluggish inventory, you can take this opportunity to clear some inventory. Our company has Micron 8Mb/16Mb/32Mb/64Mb/128Mb/256Mb/512Mb old part number inventory, customers in need, please inquire for corresponding sales. For Macronix, due to the fact that some older models are under the control of the original factory, prices have skyrocketed and delivery dates have increased, and market prices have reached a record high. Cypress's large-capacity parts have been received less recently. Customers are requested to prepare the goods as soon as possible. Winbond’s Nor flash is still very popular. From the previous small-capacity shortage to the large-capacity shortage, the prices of 64Mb, 128Mb, and 256Mb have soared, and it is difficult to get the spot. For some material numbers, market hoarders have a small amount of spot inventory, and the price has sold to sky-high prices. This wave of out-of-stock price increases is expected to continue until January next year. Therefore, customers in need can buy goods in advance, buy early and feel at ease.

EMMC

Almost every time the price increase comes, EMMC is the most stable type of product, and the price increase speed and price increase are far less intense than DDR3. Therefore, according to our observation, if the price of DDR3 products rises a lot, it is safer to buy some EMMC as inventory. However, the demand for EMMC is relatively stable, and there will continue to be demand for terminal purchases. EMMC 8GB is still the most in demand at the moment, and the current price fluctuates around US$2.05. The supply of EMMC has always been sufficient, so it is safer to properly prepare safety stocks according to actual needs. In terms of SanDisk, the original factory has been tight recently, and the current inventory is limited, and there may be a wave of shortages.

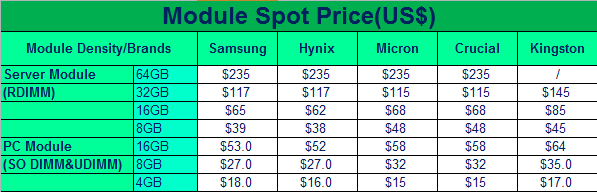

Memory Module

The recent wave of price increases and shortages of stock has made the demand for memory sticks somewhat improved, and market channel merchants have also shown signs of increasing inquiries and purchases. It may be affected by the power outage of Micron, which has made D4 products popular, and PC and NB memory sticks have risen a few overnight. It is said that some spot merchants have received goods. The price of server memory sticks has also been driven up slightly, and the purchase is stronger than before. At present, the C version of the memory stick is still relatively out of stock, and the new version of the D generation 16nm has more orders and the price is relatively cheap. Memory sticks have actually reached a relatively low point recently. Once the demand rises due to insufficient supply, it is believed that the price will rebound significantly. Our company has Micron server memory module MTA36ASF4G72PZ-2G6E1, which is large in quantity and beautiful in price. Please inquire for details. In addition, PC memory modules, 4GB: MTA4ATF51264AZ-2G6E1; 8GB: MTA8ATF1G64AZ-2G6E1, are all in stock. Notebook memory 8GB: MTA8ATF1G64HZ-3G2J1, welcome to talk in detail.

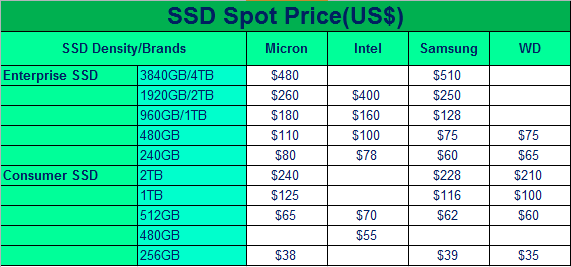

SSD

The price of enterprise-class SSDs has been relatively stable in the past month. There is no obvious sign of decline for both large-capacity and small-capacity SSDs. Small-capacity 240GB and 480GB have fewer stocks recently, and prices will fluctuate slightly as demand increases. Continue to fall, the decline is also considered to be large, and it is possible that once the demand rises, the price will reverse and rise at any time. The supply of consumer-grade SSD PM981a and PM981 has not been too much recently, but the market and client demand are also weak, customers accept the low price, and it is difficult to talk about the ideal transaction price. Consumer-grade 256G has some buying demand recently. You can watch the arrival of this one. Micron, consumer grade 512GB: MTFDDAK512TDL-1AW1ZABYY, please talk about it in detail if you have any needs.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

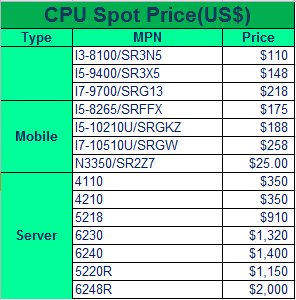

Close to end of 2020 ,compared with Nov. the supply situation is tighter , but market show different situation ,Mobile price moving up, and in shortage , but Server and DT is not as hot as mobile .

1. INTEL Notebook

We still can see some offer from market on the beginning of Dec. but as close year end the supply will turn to tight for sure , like we can see offer of I5-10210U last week ,but today ,all the parts have been sold out already ,about 10k quantity , and now we still can see some offer of I7-10510U ,price at US$255 , others low end parts only have small quantity to offer ,like N3350 price at US$24 , N4100 at $31 , about 2-3k , with more close to year end ,the market will be more complicated , maybe some supplier have stock want to clear before end of year , so we only can monitor but we forecast the tight supply situation will kept to next Q1 or even Q2 .

2. DT market

AMD is the star , whole AMD DT CPU is in tight , and highend parts like 5800X ,5900X all in tight supply.

3. Server market

Low end XEON demand is good , and less stock offer from market , but price keep stable ,for mid and high-end XEON ,price face drop , most because of the bad demand . 4210 price US$350 ,4214 price US$495 ,6234 price US$1750 ,6248R ,US$1990.

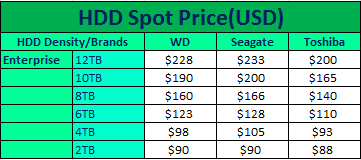

HDD

HDD

The HDD demand is very got recently, due to the use of Miner, bring a wave of enterprise HDD demand. Especially for the below capacity 8TB, 10TB, 12TB and 16TB, so the stocks of these capacity goods is not left so much from all agents side, and the stocks remove very fast.

We also clearly feel that nearly the end of the year, our OEM customers are actively preparing to keep stocks. And overall, the market is very hot, the price of enterprise HDD is stable at present.

Quiksol have some stocks of 12TB and 16TB parts, what’s more, the price is very competitive, if you have any demand, we can discuss deeply.

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat