Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

On the Qualcomm side, the main theme in December is still shortage and long lead time. The lead time of the whole series of materials has been extended to more than 30 weeks, and the lead time of CSR88 series has reached more than 33 weeks. The original factory does not support any pull in plan at present, and the end customer arranges and divides goods according to FCST. The market is still severely short of goods, spot prices sky rocketed, supply exceeded supply.

Hot shortage parts such as CSR8635B04-IQQF-R, CSR8811A12-IQQD-R, QCA1023-0-115WLNSP, IPQ-4029-1-583MSP-MT-00-0 and so on.

In addition, the BLUETOOTH chip CSR8670/CSR8675 applied in TWS field, QUIKSOL has a good order channel and supply of goods, welcome to exchange. (Quiksol)

The ups and downs of STM in the past three months can be seen from the price changes of STM32F030C8T6. From 0.6 US dollars in early September to 1.1 US dollars at the end of September, at the end of October, the price once soared to about 2 US dollars. By the end of November, the price increase entered the second half of the period. It has shown a slight weakness, and the price has fallen back to 1.5 US dollars. Although the current 1.3 US dollar has fallen sharply from its peak, there is still some distance from the price before the big increase. It is presumable that the price decline in the second half delinitely has something to do with the well-known prediction of wafer indispensability of the upcoming 2021.

Various brands are all bearing the same problems such as out of stock, short production, and extended delivery. The shortage of wafers in 2021 is no longer a panic, and I am afraid it will be truly implemented. The price of STM orders in the first quarter of next year is slowly stabilizing. It is recommended that you make plans in advance. Whether it is a price increase to jump in the queue, or sponsorship of the machine, the wafer problem will be solved even if slowly. As long as everyone works together, chips will still be available to sell next year! (Quiksol)

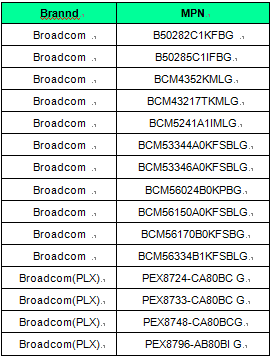

Since Broadcom entered December, the demand has declined compared with the previous two months. However, due to the sharply extended delivery period, some customers still made some preparations. According to the agent’s reply, delivery time needs to be extended to 39 weeks around. With such a long time, it is expected that there will be a period of shortage of goods in the first half of the year. It is recommended to make preparations in advance. In the near future, the WiFi module (BCM43XX) is expected to be very scarce. For example, the cost of BCM43217KMLG from the original cost of about 1usd has been speculated to more than US$2. (Quiksol)

Here are our on-hand stock and parts with competitive pricing:

The shortage of NXP became more and more tough in December, long lead time, order stripped often, price increasing is the mail trend in this month;

There is a big shortage of material numbers used in the automotive field. MCUs which MPN starting with Sxxx, and those starting with TEF which used in car radios and TJAxxx products all in big shortage. The market spot price has increased to a certain extent depending on the specific situation.

The supply of pressure sensors is still tight, but it has improved a lot compared to the beginning of 2020 when COVID-19 happened;

LPCxxxx MCUs are also out of stock due to long cycles and some sensitive channels;

It is necessary to continue to pay attention to the current supply situation of NXP and prepare Q1 reserves in advance, because it seems the worse situation would not be better before Apr of 2021. (Quiksol)

Recently, news about the shortage of car materials appears frequently in Moments. Indeed, the shortage of Infineon in November was more showed on car models.

Infineon's MCU production capacity moved to 5G production before the COVID-19, then affected by the epidemic , The long delivery time and shortage have plagued us the whole year. Nowadays, the large-scale production of automobiles caused more shortage and imbalance between supply and demand. Automobile shortage models such as :MCU: XMC1302-T038X0064 AB and TLE series TLE4250, TLE4945L TLE6711G, etc. The shortage of auto materials may be continued until the first half of next year.

Not only car models, but also normal materials are also in a state of shortage due to the shortage of wafers and epidemics repeated. Although Infineon didn’t officially announced the price increase, the price increase and delivery time will become a fact. We can reserve stock up early for parts with stable demand. (Quiksol)

Due to the shortage of raw materials and wafers, RENESAS scheduled delivery date which is far away from our expectations. The delivery date of this Month's New PO which is scheduled to May-June 2021.Moreover, Renesas officially announced a price increase notice which effect from January 1, 2021 with 15% to 100% price increase, covering more than 3000 part number; Involved part number which has stock increased price immediately after this Notice, for example 80HCPS1848CBLGI, 80HCPS1848CBRI, etc., please pay attention to network communication, converter related part number, and suggest to place order in time. (Quiksol)

About Murata, when it comes to passive materials, Being the boss of the industry, Sales account for the largest share of the world's passive market, Every move has an impact ~ its main product, Capacitors, inductors, diplexer filters, etc., A wide range of applications ~ starting in2020, The outbreak has been through, By the end of the year, Still heavily influenced, Production capacity is severely affected, Plus this year's 5G market popularity, high-end cars and car market 5G and AI smart wearable devices, Bluetooth headset, NB and other markets, Capacitors, Inductance, Especially filters, Duplexers and other components continue to be out of stock SAYF、DLW.DLM /DL /DLP / car gauge capacitors and other supplies are tight, Delivery of some components up to 30 W.

The reduction in agency stores at the factory end has also resulted in a reduction in the supply of materials, Control of shipments will also affect the supply and price of products, In the short term, The shortage will continue, Spot demand will continue. (Quiksol)

On December 7, 2020.12.7, Microchip once again announced that due to extremely high demand for its products, the number of orders yet to be delivered from the original factory continued to increase in the first and second quarters. As a result, beginning on 2021.1.1, the original 45-day window period was extended to 90 days. This shows that the order growth, delivery extended. The agent said that the current orders cannot be seen a lot of delivery as scheduled, the original factory has a jump ticket of the situation increased. At present, some part of Microsemi cannot confirm the delivery date, and even have been reported for more than 50 weeks.

Due to the extended delivery period, the demand for microchips will gradually increase in early December 2020, especially the VSC, JAN and SG series of Microsemi, which are also the hardest hit areas for stock shortage. The agent predicts that the shortage of the whole series of microchips will be more serious next year. If there is a definite demand for the goods, please try to give the order to your supplier in advance. Being available in 2021 is the way to go

Our company has a long-term demand for microchips. If you have a superior channel and material number, please contact us for negotiation. (Quiksol)

With the influences of wafer shortage, the chip market is still actively, however, the whole demand of TI is not very strong. Even some very shortage MPNs stillcan be pulled in the short term from end user. The reasons for the weak market may be as follows:1.TI store selling is becoming increasingly perfect, and terminals can be purchased directly through EDI which a window of TI.

At present, there is only one agent. Arrow's annual business in 2020 has been over-fulfilled, and the shipment schedule needed to report to TI factory.

Under the influence of the international market, domestic substitution has become a trend. In addition to the lower cost of substitute chips, MPS has been used to replace some chips in many big customers and state-owned enterprises.

It is expected that Q1 and Q2 will still be active in market next year. If you have the common MPNs that are usual used, it is a good choice to prepare for the goods in advance. (Quiksol)

Under the background of the booming market, the demand for ADI is relatively small, and a large number of materials that have been out of stock for a long time have also arrived in some quantities. The price of ADM2587 gradually returned to the normal level. After rising to US $7 or above, ADM3053 dived to about us $4. The market has been fighting a price war.

However, some general materials are still in short supply, and the follow-up delivery of REF195GSZ is expected to ease, but the book price is still in the market; the market price of ADUM1201ARZ is still at US$0.7.

Although there is less demand for ADI in the near future and the market competition is fierce, due to the shortage of wafer and production capacity, it will take some time for the supply-demand relationship to return to balance. Even if the market is fighting a price war and the future delivery date is not optimistic, the overall price will remain at a high level. We can try more channels of agents and original manufacturers to get better support. (Quiksol)

Demand for ONSEMI remained strong in November, power management IC, MOSFET and IGBT are the main out of stock products, in particular, some NUP, NGT at the beginning of the material number, delivery time has been extended to more than 25 weeks. In addition, the recent increase in the demand for chips in the automotive industry has affected many brands including ONSEMI, There is a tight supply of materials related to car specifications , the prices have risen accordingly, some materials at the beginning of NCV and NCP are worthy of more attention, industry insiders analyze whether this wave of automobile shortage is due to the epidemic situation, and the chip industry's demand forecast for consumer electronics and automotive electronics in the first half of the year is too conservative, and insufficient preparation for market demand in the second half of the year, coupled with the arrival of the traditional year-end production peak season of the automobile industry and the continuous rise in the demand for new energy vehicles, therefore, enterprises in all links of the follow-up industrial chain will lengthen the period of stock preparation, In addition, chip production capacity is still unable to improve in the short term, the rise in chip prices may be inevitable. (Quiksol)

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat