Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands:Micron, Samsung, Hynix,CPU, HDD

Overview:

Recently, the price of the memory market has skyrocketed. There are always customers asking if the price can be lowered. Existing stocks are very valuable now. Today's price is better than tomorrow, and tomorrow's price is better than next weeks’. No one will be able to know when and how high the price will rise.

In the first month of 2021, memory has brought a rapid rise in the market. Recently, the market can really be described by the word “madness”. This madness should be a chain reaction of the entire industry chain. Insufficient production capacity on the supply side and a surge in demand for consumer terminals have led to increasingly severe shortages and price increases, and even signs of chaos in the entire upstream supply chain. In this wave of rising market, the craziest thing is the GDDR memory part. Due to the continuous hot demand for mining machines and game console products in recent months, the price of the video memory part has risen. When will the stock-out market in 2021 last? Observing the current situation of the entire industry, I believe it will be difficult to improve in the short term. It is advised to keep some safety stock.

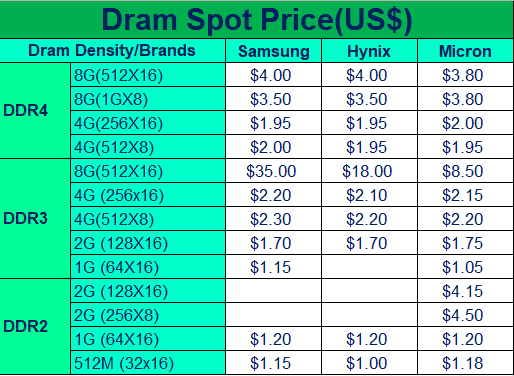

DDR4

Recently, the shortage of DDR4 has not been alleviated. Due to the small inventory of the market itself, the recent increase in demand from one big OEM has led to a significant increase in market prices. Samsung and Hynix DDR4 8Gb prices have both risen to about US$4.00. DDR4 4Gb has risen to around US$1.90. It is understood that the original factory is currently unable to meet the orders placed by most customers, causing many factories to have to buy stocks at high prices from the market. As for Micron, DDR4 has been out of stock since last November, the 8Gb capacity has not shortened the delivery period so far. It is expected that the out-of-stock phenomenon will continue until after March and may be slightly relieved.

DDR3

The rising market this time can be said to start with DDR3 2Gb. We all know that the bidding of operators in recent months has greatly increased the demand for terminal boxes and optical modems. The main demand for these products is concentrated in DDR3 2Gb and 4Gb capacity. In addition, Hynix announced the suspension of 2Gb production and the shortage of original wafers in Nanya has caused the price of DDR3 2Gb to rise from US$0.95 to a high price of about US$1.70. DDR3 4Gb has been affected by the big demand of one big OEM. Recently, the price has risen from US$1.50 to US$2.20. Many small and medium-sized factories are facing serious shortages. As a result, materials that are in need for production must be purchased at high prices from the market.

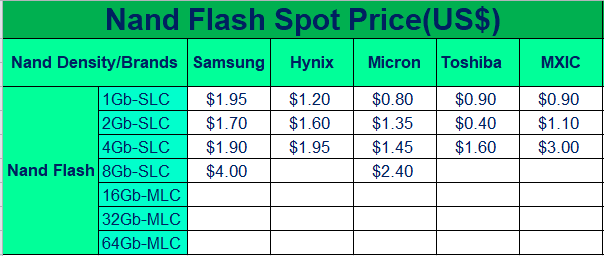

Nand Flash

Since November, the consumption of electricity meters has increased, and the demand for WIFI 6 products and communication is also using SLC Nand, which makes the demand for SLC Nand flash more and more in short supply, whether it is Micron, Samsung, Kioxia, Macronix, Winbond, ESMT, the delivery time is usually recorded in months, and the market price is soaring.

Nor Flash

Winbond and Macronix's small-capacity Nor flash prices have continued to rise for nearly half a year. Recently, Micron Nor flash has also seen price increases, the delivery period has been lengthened, and the demand for large-capacity has increased sharply. Some customers who need it must plan ahead. Macronix’s delivery time is increasing, and the packaging and testing plant must cut off part of the packaging capacity due to the surge in orders, making the already difficult delivery time even worse.

EMMC

In the past weeks, the price of EMMC has increased wildly, and the demand has increased significantly compared to before. Many channel merchants have inquired about the price to find the goods, causing the price to continue to rise. For Samsung, the price of EMMC 4GB has risen to around US$2.10, the price of EMMC 8GB has risen to around US$2.30, the price of 16GB has risen to around US$3.35, and the price of 32GB has risen to around US$6.50. The lead time of SanDisk's conventional models has been extended from 4-6 weeks to 10-12 weeks. Recently, the supply of small and medium-capacity parts of EMMC is relatively short. Pay more attention to small-capacity parts and prepare appropriate safety stocks.

Memory Module

Recently, there has been a serious shortage of server memory modules, and it is difficult for channel vendors to get sufficient allocation from factories to meet their end customer’s demand. Whether it is market spot merchants, distributors, or end customers, all of them are looking for goods from the market, and everyone wants to stock up on the corresponding inventory at a low price, but it is currently difficult to get a good price. Especially in the 32GB part, the most obvious inquiry is to find the goods. The spot quantity in the market is limited, and the quotation has been as high as US$135. It is said that the original factory will release the mentioned parts soon. You can learn more about the original factory’s delivery. The PN part has been relatively stable recently, and the market has no obvious signs of rising.

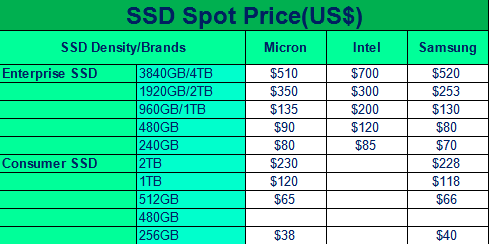

SSD

The demand for enterprise-class SSDs has improved recently. Suppliers currently have low stocks and prices have increased slightly. 240GB and 480GB are out of stock for small-capacity parts. Pay more attention to the price changes of small-capacity parts. The supply of consumer-grade SSDs PM981a and PM981 has not been too much recently, but some spot vendors in the market have prepared corresponding inventories last month, but this month's poor demand has caused prices to not continue to rise, and the current supply and demand are stable. SSD is expected to fluctuate steadily and slightly soon.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

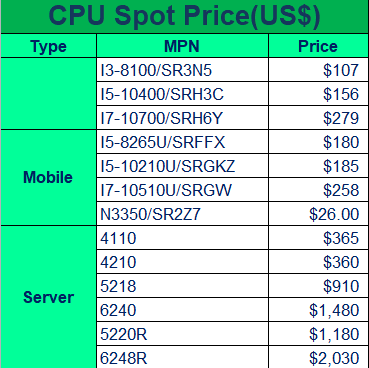

Entering 2021, the CPU market is “Quiet “ in comparison to how it was in 2020. The reason is mainly due to lack of demand, as IC and LCD are facing serious shortages. CPU market especially NB CPU can only wait for the return of 2020’s condition. This is due to the demand of NB which is still strong. Both INTEL and AMD are still facing supply issue, hence the shortage situation has not changed.

1. INTEL Notebook

Notebook is still the hottest market of CPU, supply keeps tightening, price remains high. Although we noticed some 11th generation parts offer, like I5-1135G7 but other items, including the 10th generation is still in shortage. Like I3-1005G1, we do not see any offer from OEM or Distributors. Low-end product, N4020, N4200, N5000, N3350, J1800, J1900 price all at high range and supply is not good. N3350 currently is around $26, N4020 at $32.

2. DT market

AMD have grab lot of market share and customer (especially personal customer) prefers AMD because of low price and good performance, that make all AMD DT model facing shortage, like 3200, 3600X are currently hard to locate from the market , INTEL DT price also moving up, I5-10400 price at $156, I7-10700 price at $279, all higher than 1-2month before, and it is purely due to the strong demand from end customer .

3. Server market

Server market is considered stable. INTEL have announced new generation XEON, and this may be a chance to find some room to deal XEON CPU. AMD is also hot in server market, most of the project which used for bitcoin mining is using AMD server EPYC CPU. However, AMD supply is bad, very hard to get a stable supply even from Distributors. We’ll say that Server CPU is a good market focus and you will find a good way to deal.

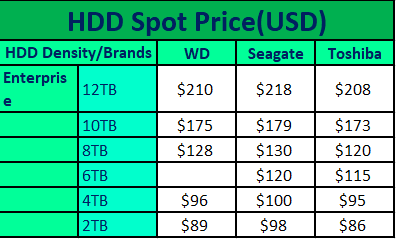

HDD

HDD

NB 2.5” HDD have had a good sales number in 2020 because of the whole NB market have grown up about 25%. But HDD is not facing serious shortage like CPU, all because of the stable supply. Recently the supply of 2T, 4T, 6T enterprise HDD is tight, price have move up $1-2 each. But the price will keep dropping as SSD is more and more popular even in enterprise market.

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat