Dear customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence report to the electronics supply chain industry. We hope you find this issue of Market Insights valuable, and we welcome your feedback at Quiksol@quiksol.com.cn

Brands: Micron,Samsung,Hynix, Nanya, Kioxia, MXIC, Winbond,CPU.

Overview:

The Chinese New Year has just passed a week, and the memory market, which has been silent for more than ten days, has exploded this week, prices have risen rapidly, and memory has entered a bull market. Demand from the market and from the factory side is fierce, memory prices continue to rise, and the shortage of goods is even more severe. As we all know, in 2020 Samsung, Hynix will switch its memory production line to CIS sensors. However, due to the continued strong demand for 5G, AI, laptops, tablets, game consoles, etc. in recent months, the reduced memory output cannot meet the strong demand. During the Chinese New Year, Samsung's Austin factory went out of power, making the originally tight supply chain worse. According to the current industry conditions, it is predicted that the supply will continue to be in short supply and it is difficult to improve in the short term. Whether it is the earthquake in Japan or the snow disaster in Texas, it is a big blow to the current extremely tight semiconductor production capacity. In addition, the production capacity of foundry is full, and everyone must spend high prices to compete for production capacity. All product lines have one thing in common: shortage! The prices of most MPNs are rising!

DDR4 For Micron, prices have risen compared to before the Spring Festival, and the market has gradually arrived. After the holiday, Samsung's DDR4 prices increased significantly, and the supply continued to be tight, especially for some 18-nanometer models. Samsung and Hynix DDR4 8Gb prices have both risen above US$4.50, and DDR4 4Gb prices have risen above US$2.20. Demand has continued to be strong in recent days, causing prices continue to rise without stopping, and customers must purchase goods at high prices from the market. In the case of continued tight supply, the price may be difficult to re-adjust. It is recommended to buy as soon as there is demand.

DDR3 Returning from the holidays, prices have risen again, and shortages have reached an unprecedented level. As for Micron, DDR3 4Gb and DDR3 2Gb are the two most lacking materials on the market. They are undoubtedly the star products in the price increase. The price has risen nearly twice as much. The current rising trend has not eased, and the shortage is still carrying on. In this wave of rising market, the price of Samsung DDR3 2Gb has risen from US$0.95 to about US$3.0, which has tripled and hit a new high in the past five years; Samsung DDR3 4Gb is also in tight supply, and demand continues to be strong. The price rose to more than US$3.3 after the Spring Festival, many factories accept high-priced replenishment, I believe it will be difficult to alleviate in the short term. For Nanya, the original factory could not meet even half of the needs of major customers, so it had to give up the needs of small customers and try to keep major customers. Since Nanya's market share is far worse than that of the three major brands, and the difference in production capacity is even greater, the price increase was the earliest in this shortage, second only to Samsung.

Nand Flash The most out of stock soon is 1Gb SLC Nand flash, and the price increase is also the largest. Major industry customers have already contracted the original factory's production capacity in the next few months, and prices are expected to continue to rise. The original factory has also begun to adjust prices one after another, and it is expected that the shortage will become more and more serious in the future. Customers need to prepare the goods as soon as possible, and it is expected that it will become more and more difficult to obtain the goods. Winbond’s 1Gb SLC Nand flash has seen an amazing rise, and Nand’s production capacity is very tight.

Nor Flash Recently, Micron Nor flash is almost out of stock, and most of the delivery time has been pulled to three or four months. The gap continues to expand. Winbond is out of stock across the board, prices are rising, and market demand is strong. The production line's capacity remains fully loaded. The supply is very tight. The original factory's distribution is very small. Some insiders predict that Winbond's Nor flash will be out of stock. There will be no relief in the second quarter. Macronix’s normal delivery period has now reached 24weeks, and prices have risen a lot. Customers in need, please prepare as soon as possible.

EMMC Before the Spring Festival holiday, some brands have shown signs of price increase and they have been out of stock. After the holiday returns, the prices of various brands and capacity have risen by a large amount. Goods will become more and more difficult.

In the week after the Spring Festival, EMMC also saw a large increase, and demand was relatively strong, especially the shortage of 16GB parts. For Samsung, the price of EMMC 4GB has risen above US$2.20, the price of EMMC 8GB has risen above US$2.8, the price of 16GB has risen above US$3.9, and the price of 32GB has risen above US$7.1. Recently, the supply of EMMC has become more and more tight, and appropriate safety stocks can be considered.

Memory Module After the holiday, the server memory module is still out of stock, and it is difficult for distributors to get the distribution from the original factory. Especially in the 32GB part, there are many inquiries on the market and the factory to find goods. The market quotation has been as high as US$145. The terminal cannot accept the current high price, and the 16GB part does not have much increase. After the holiday, the price of PC-side memory sticks has increased tremendously. The market price of 8GB is reported to be more than US$38, and the price of 16GB is reported to be more than US$70. The supply of modules is also tight at the moment, and the trend is expected to rise, and the price may be difficult to lower in the short term.

SSD The price of some enterprise-level SSDs is relatively stable without much fluctuation. The supply of consumer-grade SSD PM981a and PM981 has been small recently, and the price will also increase after the holiday. It is expected that SSD will fluctuate steadily and slightly soon. With strong demand in the next month, prices are likely to rise sharply.

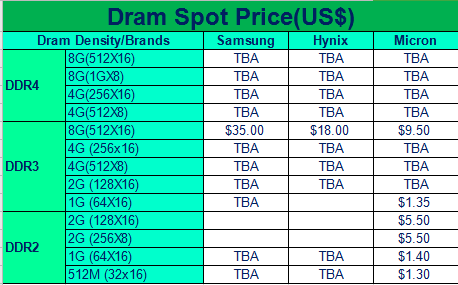

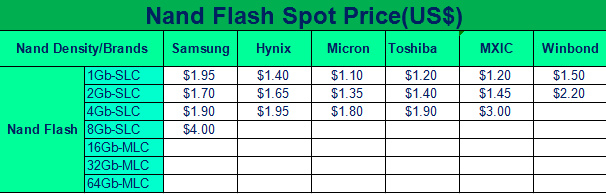

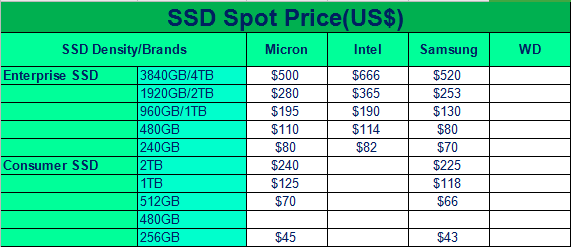

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

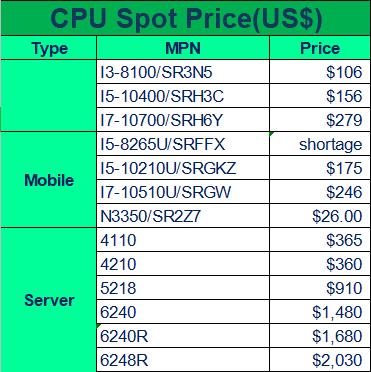

Compared with other IC or memory chip, CPU market is “quiet“ – meaning to say its price is stable and no big demand from OEM side. We would like to make a forecast that Mobile CPU including both INTEL AND AMD, will be in tight supply from Mar. AMD EYPC are currently facing shortages and will get worse in time to come.

1. Notebook: supply is tight, but current demand is less than Jan (most likely due to CNY holiday) and some IC in huge shortage. The 11th generation parts, for instance: I5-1135G7 and I7-1165G7 will be the mainstream in next one or two months. N4020, N4200, N5000, N3350, J180, J1900 price all at high range and supply is not good with only 2-3k from market. J1800 $21 about 5k; J1900 at $35 ,about 1-2k.

2. DT market: AMD is still in the limelight with its shortage and price moving up. INTEL will be announcing its 11 generation parts by end of Mar. Ryzen 3200, 3500X, 2400, 3900X will be the key model. INTEL DT also shows good demand from end customer, 10100, 10400, 10400F is the key model.

3. Server: like DT market, AMD EYPC are in constant shortage, demand is strong but no supply from AMD. 7542 ,7742 ,7302p,7262 etc will be the key model. INTEL XEON are relatively stable.

4. IOTG: South Bridge and LAN chip and wifi will be a hot part, all facing shortage, including H310C, B460, H410, 210AT, 211AT, 82583V, AX200, AX201 - all these faces tight supply and leadtime from INTEL will be 6 -8 weeks at least unlike the previous leadtime of 2weeks. As a result, price for such parts have moved up: 211AT from $2.0 to $3.5, AX200 $9 and AX201 $11 now.

Pls take as a reference of below table.

If you want to have business with us, please contact our disty sales:

Mr. Zhang:+86-183 6275 0919

Ms. Yang:+86-180 5109 2629

Ms. Yao:+86-135 1055 9053

If you have enquiries, please send e-mail to RFQ@quiksol.com.cn

If you want to communicate with our professional buyers, please contact

Memory@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat