Dear valued customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence reports from the electronics supply chain industry. We hope you could find this Market Insights valuable, and we’d love to get your feedback at Contact@quiksol.com

Brands: Micron, Samsung, Hynix, Nanya, Kioxia, MXIC, Winbond, CPU, HDD

1, Even the DRAM price has hit rock bottom and shown an upward trend, demand is the key at this point;

2, Flash manufacturers have been expected to adjust the supply and demand balance by cutting production and raising contract prices;

3, The module market is actively raising prices, but demand continues to be low. Will price increases materialize?

4, Intel 11th generation notebook CPU becomes shortage again;

5, Intel Lan chips prices tend to stable, Cost Saving demand is increasing;

6, The server CPU inventory is overstocked and most of the OEMs are clear their stocks;

7, The GPU shortage still go on, the price of some items keeps high level;

8, The price of HDD has been raised again, it becomes challenge to do the order.

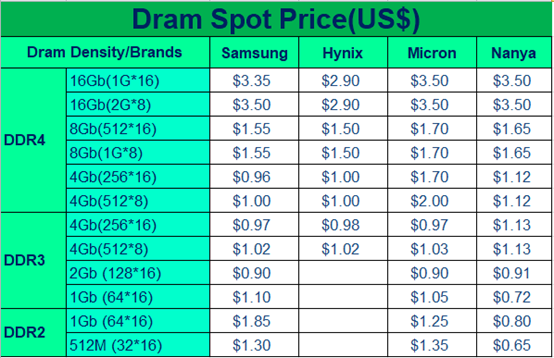

1. Even the DRAM price has hit rock bottom and shown an upward trend, demand is the key at this point.

After the production reduction of the three major storage original factories, DRAM prices have been relatively stable this year, and the declining price trend has gradually slowed down. But DRAM prices remain low due to sluggish demand.

The current attitude of the original storage factory is also to promote price increases to avoid continuing losses. Overall, storage prices seem to have bottomed out. Storage manufacturers have also revealed that there will be no more current low prices in the fourth quarter.

Samsung DRAM prices have been relatively stable in the past two months, DDR3 4Gb market price is about US$0.95, DDR3 2Gb market price is about US$0.90, and Samsung claims that it will not release the goods below this price. Micron, according to the news, foreign channels have begun to increase prices, and domestic prices are still the best. August is the end of Micron Financial, so Micron can give good support. It is recommended that customers in need can start buying inventory. Hynix, the price has fallen to the bottom, distributors and channels have said that there is a trend of price increases, which is expected to rise close to 10%. Hynix LPDDR4X and LPDDR5 are popular in the market, our company has advantageous channels to support, any demand please feel free to contact us. In Nanya, prices increased from the previous month. Due to its limited capacity, the price will be adjusted in a timely manner according to the supply and demand market conditions. Recently, the market demand has risen, so people in the industry are worried about the risk of price increases and have targeted low prices to prepare for appropriate inventory. The customer side is also considering doing some inventory planning in the current low-price stage. So, after the third quarter, maybe in the fourth quarter the market will have a new turn, but everything is still demand-oriented, and still needs to be cautious.

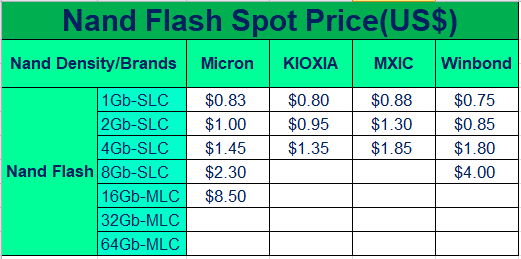

2. Flash manufacturers have been expected to adjust the supply and demand balance by cutting production and raising contract prices.

NAND Flash has become a key adjustment object for manufacturers because of the high inventory level and low demand. Flash manufacturers, such as Samsung, Hynix and Kioxia have been expected to adjust the supply and demand balance by cutting production and raising contract prices. It is said that Samsung will raise wafer contract prices and Kioxia delayed the start of production at the Japanese plant. A rebound in the market is commonly expected. Recently, the inventory of manufactures and distributors has decreased, especially the 8Gb NAND Flash, the order lead time is about 3-4 weeks, and the price has not declined for the time being. Micron, for its part, has seen little demand, and prices have reportedly reached a bottom.

Nor Flash, Micron demand is not much and the supply is good. Winbond's dominant production lines of 32Mb, 64Mb and 128Mb continue to be priced at record lows without any downward trend. Once demand improves, there will be an upward trend. MXIC prices continue to fall slightly. Some Cypress items are still out of stock and in short supply.

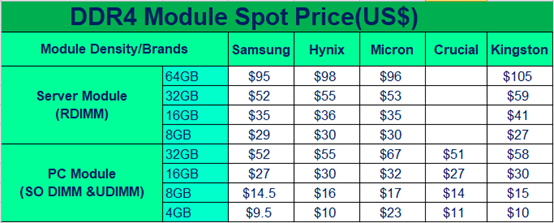

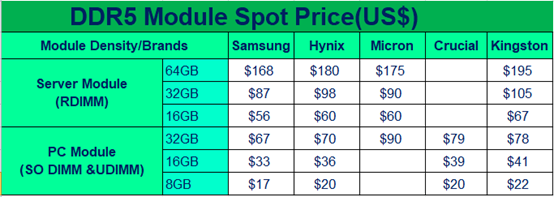

3. The module market is actively raising prices, but demand continues to be low. Will price increases materialize?

This year's module market is also very depressed. The market price has been lower than the official price, which is also affected by the downturn in PC market demand. Recently, to prevent further losses, the module manufacturers have said that they will no longer ship at low prices, and actively promote price increases, which are adjusted to rise by 8%-10%. An increase in prices seems inevitable, so customers have been sending out inquiries recently. The industry believes that the price is now at the lowest point, but the demand is not good. Recently, demand and transactions for both 8GB and 16GB PCS have increased. DDR5 PC 32GB and Server 128GB are in short supply, and the market price is still much higher than the contract price. The overall server market remains weak.

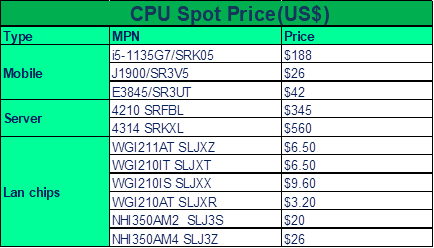

4. Intel 11th generation notebook CPU becomes shortage again.

After a few years of silence, Intel notebook CPUs are again being snapped up. Because the 11-generation notebook CPU is close to EOL, the subsequent original factory should not receive new delivery orders, so the major manufacturers are grabbing new inventory. The mainstream models of the 11th generation are almost no stocks now, and the prices of goods have risen several waves. Main models such as i3-1115G4, i5-1135G7, i5-1145G7, i7-1165G7, etc., these are relatively popular. The typical i5-1135G7 went from US$100 to US$170 today and continues to rise. From the overall point of view, part of the existence of Intel original factory control goods, and part of the factory demand has been asked in the market, resulting in repeated price increases.

5. Intel Lan chips prices tend to stable, Cost Saving demand is increasing.

Intel Lan chips with the big market

fluctuations of IC, after 2 years of ups and downs, now tends to be stable, it

can be said that the price has fallen to the official price increase before.For example, the common item WGI210AT, the highest price in history is close to

US$50, and now the channel price is US$3, which is actually the normal price.

Recently, we have also seen that some factory customers have long-term needs,

but the price requirements are still relatively high, so we need to constantly communicate with channels and customers to

achieve a double win effect.

6. The server CPU inventory is overstocked and most of the OEMs are clear their stocks.

In terms of CPU, the overall demand is relatively weak, and the PC market is in a loss shipment state. No matter for the mainstream CPU or some old CPU items, the price has been falling all the way. From last year to this year, many factories have a backlog of inventory, and to return funds, they are gradually throwing inventory out. For example, 8362,6240, some parts are still in short supply, such as 4310,4310T, and the price of these materials is still at a high level.

7. The GPU shortage still go on, the price of some items keeps high level.

Artificial intelligence has become a

hot topic this year. In the trend of artificial intelligence promoted by

ChatGPT, GPU is particularly important for the whole AI model. As the

calculation basis of the whole tide of AI, GPU has become the object of

"grabbing" by most Internet companies,mainly focusing on items of A100, H100, A800, H800 , and the prices of A100 and

A800 have soared a lot in the past two weeks, and the 80G of A800 has been

stir-fried from US$8,500 to US$13,400, In just 2 weeks, the price of A800 raised

around 30%, some industry insiders said that Nvidia is currently vigorously

promoting H800, so it leads the supply tight of A800, resulting in a shortage

in the market, the price of H800 is also much higher, and the current market is

more than US$24,300. AI chips are also affected by this wave, supply shortages,

and prices continue to rise.

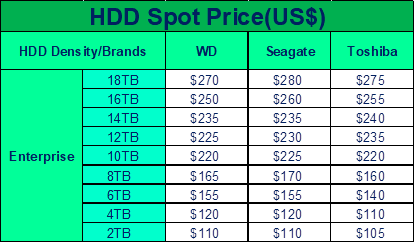

8. The price of HDD has been raised again, it becomes challenge to do the order.

July has passed, from the current

situation, although the inquiry of HDD has increased, the actual order rate is

still relatively low. Following the first

wave of price increases at the end of May, Seagate Original Factory began to

increase prices again across the board in August, and prices are still rising. Now

some large customers are sweeping goods, hoping to stock some commonly used

parts in advance before the price rises to the highest point. However, because

the original price is unstable, it is adjusted almost all the time, and the

confirmation process of customer’s order takes time, so it is difficult to get

order. Recently the most shipments of HDD is

still concentrated in the large-capacity enterprise level, especially 12TB, 16TB

& 18TB. The shipping price of 16TB is about US$260, and the shipping price

of 18TB is about US$280. Other capacities below 10TB are also shipped more,

like 4TB, 6TB, and 8TB all being shipped one after another. At present, the

price changes rapidly, the original factory will keep increasing the price,

please reconfirm the price before placing an order.

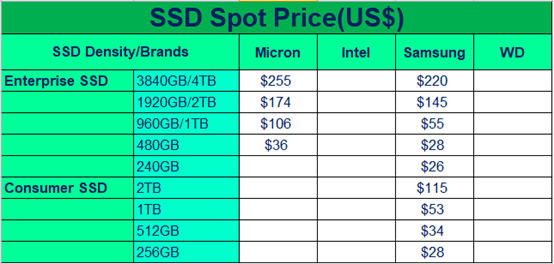

Average market price details are listed in the following table.

Pls take as a reference of below 7 tables:

Table1-Dram spot price

Table2-NAND Flash spot price

Table3-Memory module spot price (DDR4)

Table4-Memory module spot price (DDR5)

Table5-SSD spot price

Table6-CPU spot price

Table7-HDD spot price

If you want to have business with us, please contact our disty sales:

Mr. Zhang

86-183 6275 0919 Jerry.zhang@quiksol.com.cn

Ms. Yang

86-135 1055 9053 Jenny.yang@quiksol.com.cn

Ms. Yao

86-180 5109 2629 Fiona.Yao@quiksol.com.cn

If you want to communicate with professional buyers, please contact to:

Memory@quiksol.com.cn

CPU@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat