Dear valued customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence reports from the electronics supply chain industry. We hope you could find this Market Insights valuable, and we’d love to get your feedback at Quiksol@quiksol.com.cn

Brands: Micron, Samsung, Hynix, Nanya, Kioxia, MXIC, Winbond, CPU, HDD

Another concern is China announced a drastic relaxation of COVID regulations recently which has lasted for three years. The exchange rate of the RMB has also rebounded, which we believe will lead to better expectations for the economy activity. It is expected that due to external factors, the demand for servers will gradually improve until the first half of 2023, the demand for mobile devices may remain weak, and the demand for personal computers and PCs may recover significantly in the second half of the year, and the customer inventory level is expected to improve in early 2023. In addition, the demand for memory in the automotives industry is increasing, and in the post-mobile computing era, automotive storage will become an important emerging growth point in memory chips and determine the market pattern. DRAM, Flash and NAND will be widely used in various fields of intelligent vehicles in the future. In the next few years, more attention can be paid to automobile new energy related industries.

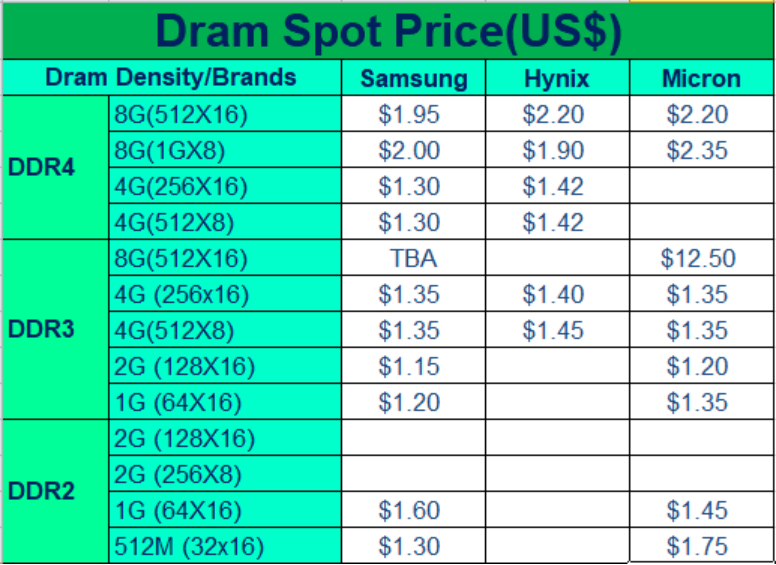

DDR4: Looking back at the memory market this year, DRAM was the biggest decline this year, with DDR4 8Gb falling the most. Compared with the lowest price in 2019, the price is again more than 30% lower this year. Demand has been weak since the end of December. In the current situation of oversupply, so that the price continues to fall. Spot vendors are still facing the problem of selling pressure and the transaction is very unsatisfactory. The market price for SAMSUNG DDR4 8Gb fell to around US$1.95, and for DDR4 4Gb fell to around US$1.30. As the market price continues to fall, no one is willing to stock goods in the recent period, no matter the upstream channel or the market spot trader resulting shortage of spot goods in current market. If there is a large quantity of demand for goods, there may be a shortage phenomenon. The price of Hynix DDR4 8Gb is relatively stable, without large fluctuations. The price of 16Gb is in a state of slow decline, the overall demand is less and a weak market. Micron, DDR4 prices are in a stable state, 8Gb commercial grade market price around US$2.20, still at the lowest point in history. It is reported that some upstream channels have sold off most of their inventory at low prices, and the remaining inventory is limited. MT40A512M16LY-062E IT:E, this Micron DDR4 4Gb, our company has a good channel, because the price tends to be stable, customers with demand can properly prepare some safety inventory.

Nand Flash: KIOXIA, due to the decrease in the output of various products, the price at the end of the year tends to be stable, but the demand is still not much. Manufacturer will take their own inventory at the end of the year to determine whether they need to clear at a low price. Our company has a better channel and can discuss if there is any demand to inquire. Micron, according to the news, due to the decrease of the cost of Nand wafer, the price of Nand products decreased accordingly. The market price of 1Gb was around US$0.90, and the market price of 2Gb was around US$1.25. Overall, there was less demand, welcome customers to inquire, we can reduce costs for you.

EMMC: There are many inquiries in the market of EMMC this month, and the supply quantity of Samsung is limited this month, so it will no longer reduce the price. Spot traders due to the previous low stock, resulting in the market recently presented a shortage of inventory. The market spot is less, and the prices tends to stabilize and rise slightly this month. The price of the SAMSUNG EMMC 8GB is currently fluctuating around US$1.77, the market price of the EMMC 16GB has risen slightly to around US$2.77 this month, and the market price of the EMMC 32GB is currently around US$3.50. There is a lot of demand for inquiry in the market this month that the manufacturers are no longer willing to reduce their prices. It is suggested that some safety stocks be prepared at the appropriate time before the year. In terms of KIOXIA, EMMC has not seen much demand recently and the price continues to be stable. As for Micron, the demand is not strong, and the supplier wants to clear some EMMC. Customers who have needs are welcome to inquire.

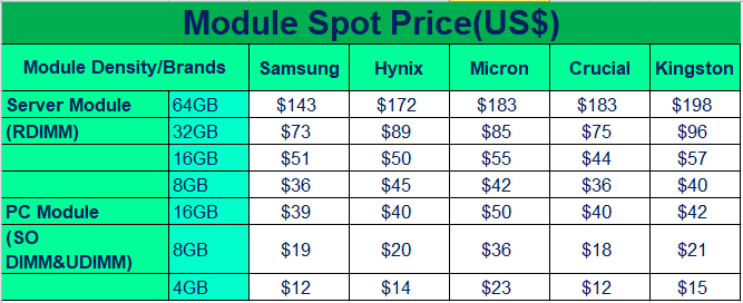

Memory Module: Module market prices have also stabilized recently. Due to the deep decline in the past few days, prices are now at very low levels, well below the 2019 lows. Recently, the price decline of DDR5 has gradually expanded, and the decline seems to have been greater than that of DDR4 memory modules. As DDR5 penetration continues to increase, and with higher rate performance, the penetration rate will gradually increase in the future. SAMSUNG PC 8GB price has been lower than US$20, and 16GB has been lower than US$40. The server module 16GB price has been lower than US$50, and 32 GB has been lower than US$150. With channel and client inventories still high, prices are likely to continue to fall. Hynix module prices have also fallen to low levels, client and channel inventories are at high levels, and market demand is weak. As for Micron, we have recently completed some transactions of DDR4 server modules with good supply channels. Customers who have demands are welcome to contact us.

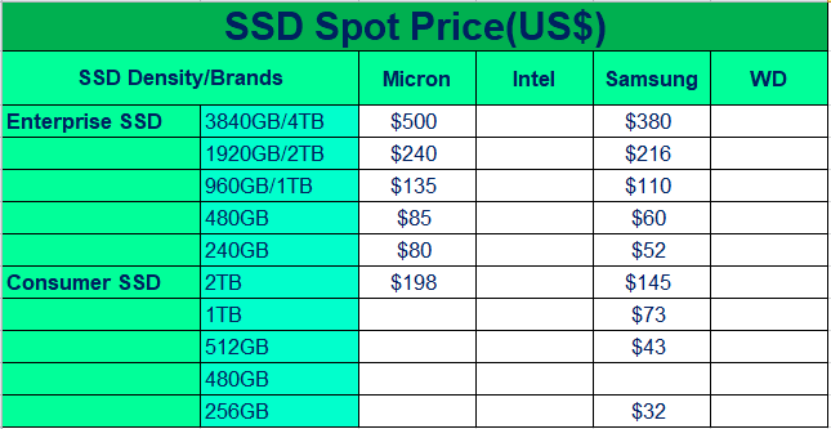

SSD: SSD demand continues to shrink, the recent emergence of enterprise-class SSD selling pressure, the overall buying is very low. Only some sporadic factories urgent order inquiry, the bargaining space is limited. Customer target price is very difficult to meet, the overall trend is slightly declined. Data center construction has slowed down and demand has delayed because of rising energy prices and a slowing economy. It is expected that SSD contract prices will continue to fall, and it is suggested that it is safer to focus on case for case recently.

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

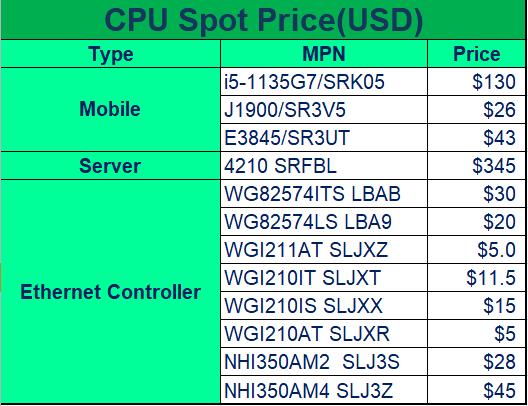

PC CPU: The overall market demand is relatively weak. The PC CPU is in a loss state when shipping to customer. Whether it is popular CPUs or some old CPUs, the delivery time is relatively stable, and the price is falling all the way. The demand of old CPU as i3-6100, i3-8100, i3-9100, i3-9500, the demand was dropped, and the price also fell down. We can see some demand of i9-9900, i9-9900K,i9-10980XE, but the stocks was little and OEM can’t get stocks from INTEL. For the Celeron series and Pentium series low end CPU, G3900,J1800, J1900, N4200 parts, the demand was also very weak, the price dropping to the bottom.

Pls take as a reference of below table.

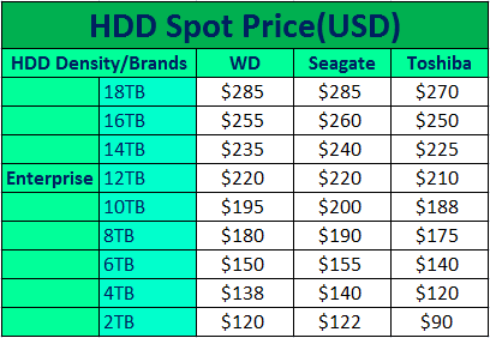

HDD

If you want to have business with us, please contact our disty sales:

Mr. Zhang

86-183 6275 0919 Jerry.zhang@quiksol.com.cn

Ms. Yang

86-135 1055 9053 Jenny.yang@quiksol.com.cn

Ms. Yao

86-180 5109 2629 Fiona.Yao@quiksol.com.cn

If you want to communicate with professional buyers, please contact to:

Memory@quiksol.com.cn

CPU@quiksol.com.cn

HDD@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat