Dear valued customers and vendors, welcome to the Market Insights-Newsletter from Quiksol that delivers timely and relevant market intelligence reports from the electronics supply chain industry. We hope you could find this Market Insights valuable, and we’d love to get your feedback at Quiksol@quiksol.com.cn

Brands: Micron, Samsung, Hynix, Nanya, Kioxia, MXIC, Winbond, CPU, HDD

Overview: The demand of memory is still weak in Q4, 2022. The current global economic recession, inflation and geopolitical conflicts cause memory chip demand continues to slump. Affected by the slump in the consumer market, some big memory manufacturers suffered heavy setbacks in their performance. They had to issue pessimistic warnings to cost down prices, cut production and reduce capital investment in order to cope with the current trend of continuous order cuts and uncertain demand outlook. Currently, the consumer demands such as smartphones and PCs remain weak and supply chains continue to destock. The market is in a state of oversupply for a long time contributed by low-price, good allocation, and fierce competition. Some customers are not willing to stock up and generally purchase on demand. Industrial control and automobile market is still in constant demand and expected to be optimistic in a long-term. Given the current market situation, the memory industry is pessimistic in general and may continue this trend till next year. Some industry insiders predicted memory demand until next year's Q2 will be difficult to rebound.

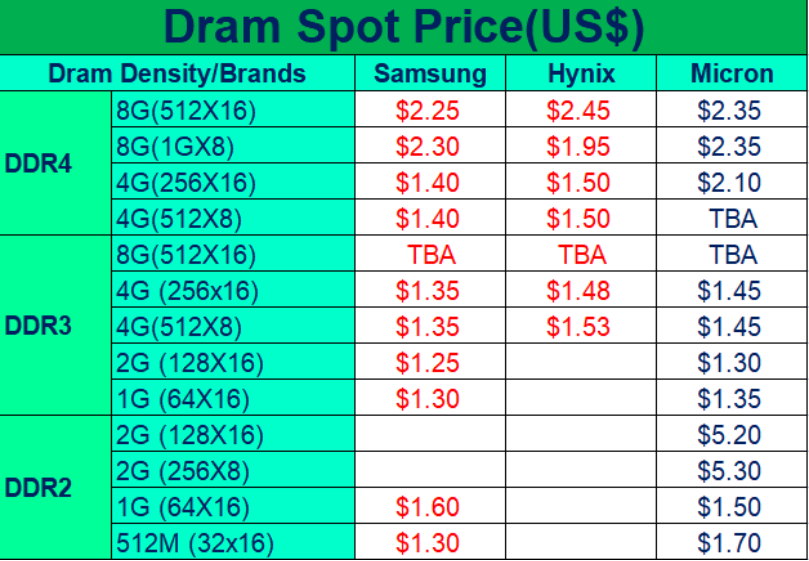

DDR4: The memory market continues to deteriorate. DDR4 as the current mainstream storage product recorded the largest decline in history this year, mainly because of oversupplied market. Samsung has been maintaining a strong combat effectiveness, expanding the market with the lowest price, and leading market share. The demand of Samsung DDR4 8Gb dropped the most this year and its market price falls to around US$2.20. The price of DDR4 4Gb dropped to around US$1.40. Samsung is still cheaper than other brands. We suggest to pay more attention to the low-price models of Samsung in future. Currently, the price has fall to a very low point, and the price is relatively stable with a little fluctuation and expected to have few changes of pricing in future. Hynix DDR4 demand is not much, mainly order on demand, and the price continues to fall. The price of 4Gb is around US$1.52; the price of 8Gb is stable around US$2.50 due to the recent end customers shipment; the price of 16Gb also falls to the lowest level in history like other capacity. Micron DDR4 8Gb market price is around US$2.20. We have MT40A512M16LY-075:E stocks on hands. Please contact us if you have any demands.

DDR3: Since the second half of 2022, affected by the continuous low demand in the consumer market and other factors, the price has been falling all the way. The end customers have postponed purchasing, which is expected to last until the first half of 2023. The market price of Samsung DDR3 4Gb dropped to around US$1.40, and DDR3 2Gb dropped to around US$1.30. Hynix DDR3 shipments are small, market demand is weak, and the price is relatively stable, which is relatively high compared to other brands. Micron shipments mainly focus on 2Gb and 4Gb universal models. Some DDR3 prices have almost reached all-time lows. Professional spot traders are waiting to see if they can purchase at lower prices. Micron's 2Gb commercial grade prices are around US$1.30 and 4Gb around US$1.40. The target price is lower and lower, mainly to sell to the end customers. Nanya 2Gb price is around US$1.28. It is difficult to deal because the customer's target price is very low. Nanya has spent NT $300 billion to build a new wafer plant in New Taipei City and has introduced several generations of 10-nanometer technology and products into this new fab, which shows that Nanya has taken root in the growth of the DRAM industry. We can continue to focus on low-priced models. Please contact us for more further discussion.

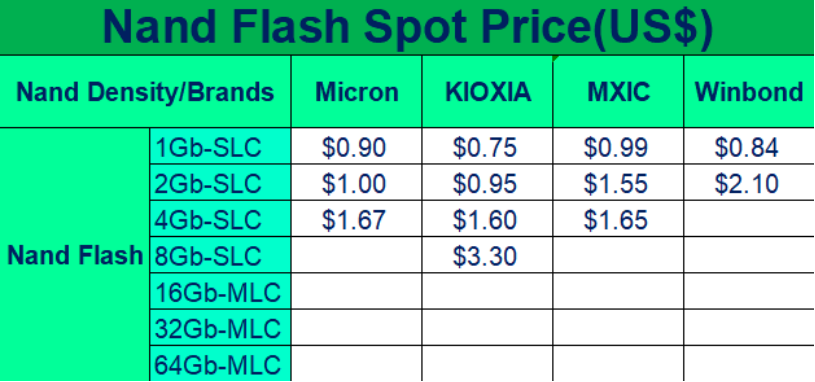

Nand Flash: Overall demand for Kioxia is weak. Since the market has not been improved, various external factors caused supply chain confusion and increased uncertainty. The manufacturer starts cutting production at Japan's Yokkaichi. Kitaichi NAND Flash fabs by about 30 percent in October, which is the biggest cut since 2012. Without any expected improvement until the fourth quarter of this year, manufacturers are adjusting their strategies according to market conditions. However, in the medium and long term, NAND market growth is predictable and will continue to grow steadily. Micron hasn’t seen any improvement in demand except sporadic demand for low-liquidity models.

Nor Flash: Cypress have some small volume. Nor Flash is still in short supply and will not be alleviated any time soon. Some models that are not in short supply are falling in price but not in demand. MXIC prices are steady, while Winbond prices are down steadily. Manufacturers’ inventory level is still high. Our company is good at MXIC and Winbond channels, welcome to inquire. Price is negotiable with large quantity. Micron demand has fallen a lot. The arrival of goods on the supply side is gradually eased with the decreased demand from end customers. Many peer customers have stockpiled goods at high prices and cleared at a loss.

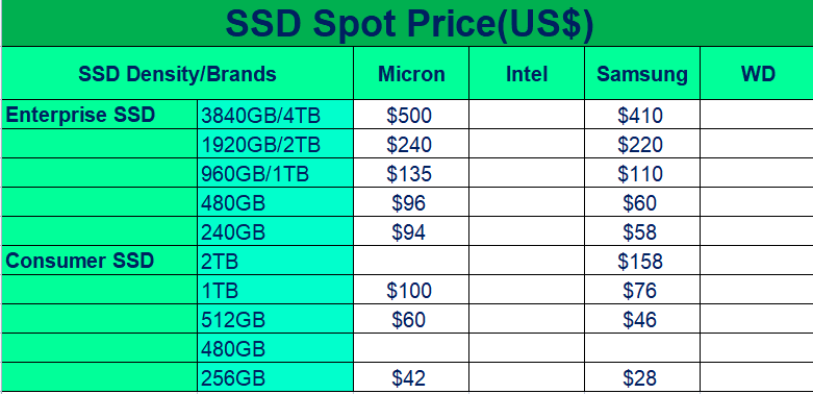

SSD: The server market slowed in the second half of the year with slowed data center construction, resulting in continued weak demand at both consumer and enterprise levels. The ongoing declined market demand results in low customer willingness to buy goods with a wait-and-see attitude. The consumer 9A1 series has recently fallen to very low levels, with relatively stable price fluctuations this month. There is not much 1TB spot stock, and the its price has recently held steady around US$75.00. 512GB price is around US$45.00. The enterprise 883 series was discontinued in October, and the supply gradually decreased. Please pay more attention to the replacement models of the 983 series and the price is also falling at present. The server market is expected to improve by 2023. In terms of Micron, we have some enterprise SSD channels with good price, as for any demand, please contact us in detail.

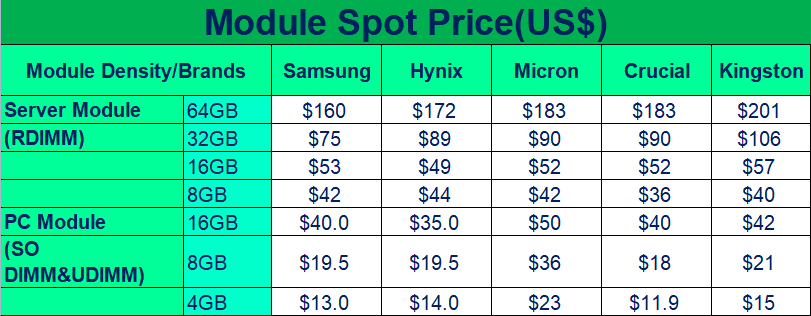

Average market price details are listed in the following table.

Pls take as a reference of below 4 tables

Table1-Dram Spot Price

Table2-NAND Flash Spot Price:

Table3-Memory Module Spot Price:

Table4-SSD Spot Price:

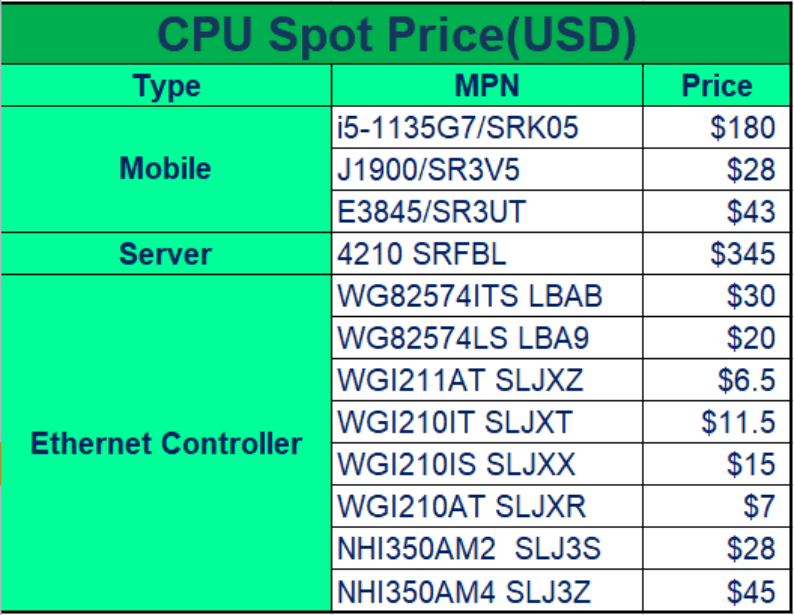

As the year 2022 is nearly to the end, the overall demand of INTEL is still weak. Looking back this year, the desktop and server market have been in a downturn, with supply exceeding demand, which has led to a continuous dropping of the price. In addition, the COVID-19 keeps repeating, and many projects of customers are delayed or cancelled. Consumer and server market is relatively down. Although Intel has made several times for raising up the official price, the market is still in the doldrums, and everyone is waiting for the winter to pass and hope the CPU spring to come.

IOTG: The IOTG product Ethernet Controller which became a hot part in the past 1year, has finally been put on hold recently. The goods from Intel manufactory have come out one after another, the big OEM customers and FDs also have got the goods ordered before. At present, the shortage of mainstream items has been basically alleviated, but there are still some items out of stock. I210 series demand has weakened significantly and supply has stabilized recently. The target price of the customer has gradually approached the original price, reducing the gap. Other conventional materials have also arrived, and prices have dropped significantly.

PC CPU: The overall market demand is relatively weak. The PC CPU is in a loss state when shipping to customer. Whether it is popular CPUs or some old CPUs, the delivery time is relatively stable, and the price is falling all the way. The demand of old CPU, such as i3-6100, i3-8100, i3-9100, i3-9500, was dropped, and the relevant price also fell. There's demand for i9-9900, i9-9900K,i9-10980XE, but the stock was little and OEM can’t get stocks from INTEL. The demand of Celeron series and Pentium series low end CPU, such as G3900,J1800, J1900, N4200 parts, was also very weak and the price was dropping to the bottom.

Server CPU: In general, the supply of the server market is relatively stable. The mainstream models 4210, 4210R, 4240, 4310 are relatively stable at present. The prices have dropped slightly and stabilized gradually. Recently there’s more stock of ice lake series item but the demand is not too much. Several popular models are still out of stock such as D-1527, E2176G, etc. XEON-D series CPUs have always been out of stock. Some uncommon items of the XEON series also lack of stocks, the lead time from Intel would be very long.

Mobile CPU: The supply of the 11th generation CPU trends to be stable and many sources have stocks. The demand of mobile CPU Tiger Lake series is very weak while more stocks coming out, so leads to many excess want to sell from OEM side. However, the supply of some old notebook CPUs is tight. But the original factory does not accept new orders, which in turn causes some IPC customers to keep looking for goods outside, mainly focusing on the 6th, 7th, and 8th generations. As for I3-6100U, I5-7200U, i5-8250U, i5-8350U, i7-8550U, we can share some stocks from our reliable source. If you have any demand, please let us know, thanks.

Pls take as a reference of below table.

HDD

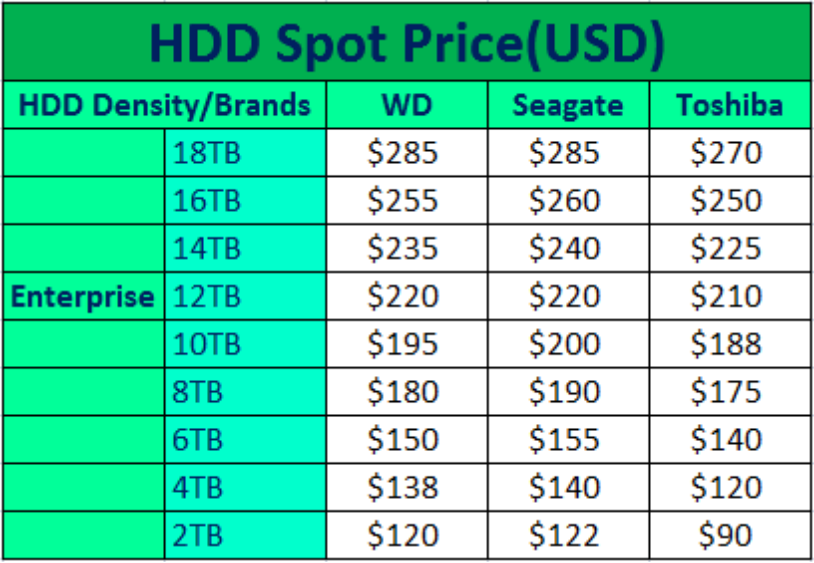

1. HDD market has been influencing by the hit of SSD in recent years. Except its slight advantage of unit capacity and price, it falls behind completely in terms of performance, volume, energy consumption and other aspects. Coupled with the decline in market demand, supply chain shocks and other negative factors, HDD sales volume have fallen sharply this year.

2. From the perspective of the supply side, enterprise-grade HDD remained relatively stable. But the demand is slightly lower than in the same period last year. According to the statistic data from TrendFocus, the worldwide shipments of HDD in the Q3 quarter were only about 39 million, down 42% from a year earlier, and the downward trend is unstoppable. Western Digital has begun to cut production due to falling market demand, which is expected to last for 6-8 weeks.

3. Although the recent enterprise HDD, monitoring HDD, and mobile HDD have been shipped, the most common shipments of HDD is still concentrated in the large-capacity enterprise level, especially as for 12TB, 16TB & 18TB. The price is relatively stable. The shipping price of 16TB is around US$255, and 18TB is around US$285. There are more shipments of other capacities below 10TB, such as 4TB, 6TB. 8TB are being shipped one after another. Customers in need are welcomed to contact us for detailed information.

If you want to have business with us, please contact our disty sales:

Mr. Zhang

86-183 6275 0919 Jerry.zhang@quiksol.com.cn

Ms. Yang

86-135 1055 9053 Jenny.yang@quiksol.com.cn

Ms. Yao

86-180 5109 2629 Fiona.Yao@quiksol.com.cn

If you want to communicate with professional buyers, please contact to:

Memory@quiksol.com.cn

CPU@quiksol.com.cn

HDD@quiksol.com.cn

(Copyright by Quiksol, welcome to reprint, please indicate the source)

Scan the QR code to add Quiksol on Wechat