根据市场研究机构Gartner的预测,到2014年,芯片设计案中采用第三方半导体IP的平均比例将比目前多一倍,但IP授权费(license)/权利金(royalty)的平均收入却将持续呈现下滑趋势。

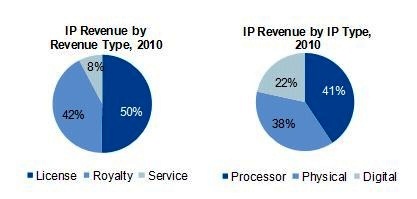

在近日于法国Grenoble举行的IP-ESC 2010大会上,Gartner首席分析师Ganesh Ramamoorthy针对半导体IP市场现况与展望发表专题演说指出:“2009年是市场大幅衰退的一年,而2010年将会有大成长;我们预期,2010年对IP产业来说会是非常好的一年,在各种营收比例方面,授权业务营收将占据五成、权利金收入占据42%、服务营收则占据8%。”

针对2011年至2014年的市场展望,Ramamoorthy举出了三个设计IP市场成长的因素,包括设计成本逐渐攀升、设计复杂度增加,以及新产品导入(NPI)时程缩短等:“当我们将以上这三个因素综合起来,意味着第三方IP的使用率将强劲成长,预估到2014年,在芯片设计案中所使用的第三方半导体IP功能区块平均数量将加倍成长。”

他并指出,根据与客户所做的快速分析显示,消费性电子领域需求将出现快速成长,但最大的成长将来自汽车与工业控制市场的需求;这些需求都将推动IP的使用。

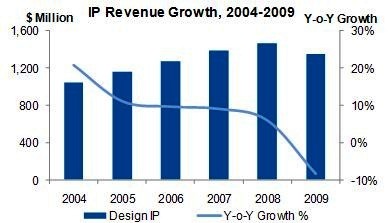

2009年是IP市场大幅衰退的一年

(来源:Gartner)

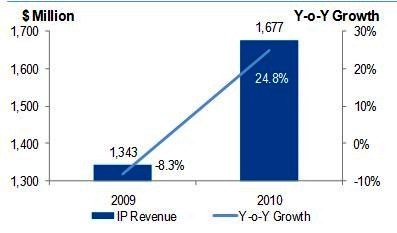

2010年IP市场将出现大幅成长

(来源:Gartner)

{pagination}

Ramamoorthy举出2011年~2014年这段期间内可能阻碍设计IP市场成长的两个因素,其一是IP商品化的风险将会升高——第三方设计IP的使用率将成长,但授权费/权利金平均收入将因此受到冲击;其二则是,设计IP的整体有效市场(Total Available Market,TAM)将会缩水。

22010年IP市场各项业务与不同种类IP营收

(来源:Gartner)

此外Ramamoorthy也指出了2011~2014年间的4个IP市场发展趋势;首先,根据他的观察,IP授权费/权利金平均收入下滑的情况将持续到2014年以后。

其次,他也预期,EDA供货商将对IP市场的成长扮演重要角色,主要是因为他们接近芯片设计业者,并透过预先验证、硅验证的IP,推动更多第三方IP的使用率:“这将为芯片供货商节省时间与成本,也可为EDA供货商抵销一部分设计工具销售业务的颓势。”

第三个趋势则是,Ramamoorthy预见在接下来的五年内,IP市场的竞争格局将出现巨幅变化;他指出,在景气衰退之前,设计服务的价值很低,但在景气复苏之后,预期先进设计支持服务将会崛起。设计服务的价值将随着为客户减轻整合IP的痛苦而提升;此外无晶圆厂业者与晶圆代工厂,也将分食IP市场大饼。

第四个趋势是,IP供货商会需要在后景气衰退时代,重新定位其角色与反应策略。确实,IP供货商得与芯片供货商更加密切合作,以开发标准化的IP组合与使用架构,也得与EDA供货商共同强化IP的整合、开发与产品蓝图配置。IP供货商还需要扩充新的技术与支持能力,协助芯片设计工程师减轻工作负担。

{pagination}

2015年之后将出现更艰难的挑战?

至于2015年之后,Ramamoorthy认为市场将进入艰困时期:“IP产业将很难再经历两位数字的成长,IP营收将与整体半导体产业的成长趋势一致;两位数字的高成长率时代已经结束了。”他表示,IP权利金收入将衰退,原本推动市场成长的产品领域将走向成熟,再加上没有新的可带动IP需求的杀手级应用出现。

而授权案件商机也将衰退,Ramamoorthy表示,原因是各种功能的加速整合,会让新芯片设计案逐渐减少,连芯片供货商数量也会下降。在预期2014年第三方IP的使用率将加倍的同时,Ramamoorthy也认为要特别注意EDA供货商的动向、子系统与软件的功能走向,以及处理器IP商之间的产品开发、并购或是联盟。

对于因应2015年之后的市场变化,他建议供货商透过结盟或是收购来扩充IP产品组合,也可通过与客户共同持有的IP来开拓商机;此外,将IP搭配EDA工具,并与同业、伙伴、客户、竞争者一同为IP的建构与使用订定标准架构,则是终极任务。

点击进入参考原文:IP revenue to decline beyond 2014, says Gartner, Anne-Francoise PELE

《电子工程专辑》网站版权所有,谢绝转载

{pagination}

Gartner: IP revenue to decline beyond 2014

Anne-Francoise PELE

By 2014, the number of third-party semiconductor design IP blocks in an average chip design will double from the current level, according to Gartner Inc. However, average license and royalty revenues will continue to decline.

In a keynote session at the IP-ESC 2010 Conference this week in Grenoble, France, Ganesh Ramamoorthy, Principal Research Analyst, Gartner Inc., reviewed the numbers for the years 2009 and 2010, outlined the main drivers, inhibitors and trends for the period 2011-2014 and gave a hint at what's in store beyond 2015.

"2009 was the year of great fall and 2010 is the year of big rise", declared Ramamoorthy. "We expect 2010 to be a very good year for the IP industry. In terms of revenue share, license revenue represents 50 percent, royalty revenue accounts for 42 percent and services represent 8 percent." (See below)

In his predictions for the period 2011-2014, Ramamoorthy cited three design IP growth factors: escalating cost of design, increasing design complexity, and shortening time window for NPI.

He commented: "When we put these three factors together, it means there will be a strong growth in third-party IP usage. Third-party semiconductor IP blocks in average chip design will double by 2014, and a quick analysis with customers indicates that consumer demand will grow very fast but a bigger demand will emanate from the automotive and industrial sectors. These will be driving IP use."

For this period, Ramamoorthy outlined two design IP growth inhibitors: First, the risk of commoditization will increase –Third-party design IP use will be on the rise while the average revenue per license and average per royalty unit will be hit. Second, design IP TAM (Total Available Market) will decline.

Ramamoorthy identified four design IP market trends for the period 2011-2014. First on the list is his observation that the average license and royalty revenues are declining and will continue to decline well beyond 2014.

For the period 2011-14, Ramamoorthy said he also expects that EDA vendors will play a key role in the IP market growth. Indeed, he explained that they are the closest to chip designers, and by integrating pre-verified, silicon-proven IP blocks, they will drive increasing use of 3rd party IP blocks.

Also, he continued, "this will save time and cost for the chip vendor. This will also help EDA vendors offset their ailing tools business."

A third trend, Ramamoorthy highlighted, will be a dramatic change in the IP market competitive landscape over the next five years. In the pre-recession era, the value of services offered is very low while, in the post-recession era, the analyst anticipates the emergence of advanced design support services. The value of services will be moving up with an intention to ease the pain of IP integration. Also, fabless and foundry vendors will enter the IP sphere.

The fourth trend concerns IP vendors who will be compelled to redefine their roles and responses in the post-recession era.

Indeed, IP vendors will have to work closely with chip vendors to develop a standard framework for building and using IP and with EDA vendors to enable tighter IP integration, develop and implement their roadmap. Also, IP vendors will have to acquire new skills and enhance support capabilities to relieve designers from non-differentiating overhead building tasks.

Beyond 2015: what's in store?

Looking beyond 2015, Ramamoorthy said he sees difficult times. "Double digit growth will not be easy for the IP industry. IP will grow in line with the overall semiconductor industry. The days of double digit growth are over."

Royalty will decline, Ramamoorthy continued. Traditional growth market markets will saturate and there is no killer application on the horizon yet that would potentially boost IP demand.

Similarly, licensing opportunity will decline. According to Ramamoorthy, this can be explained by an acceleration of functional integration, fewer new chip designs and fewer chip vendors.

As third party IP use will double by 2014, Ramamoorthy urged to watch out for EDA vendors' moves, build subsystems and software capabilities as well as develop, acquire or partner with processor IP providers.

And, to get ready for the post-2015 era, he advised to expand IP portfolios via partnerships or acquisition, to explore opportunities for co-ownership of IP with customers and for bundling your IP with EDA tools and finally to define a standard framework for building and using IP –work with peers, partners, customers and competitors.

Reacting to Ramamoorthy's predictions, Gabriele Saucier, CEO of Design and Reuse SA and organizer of the IP-SoC Conference, said we should not ignore the power of innovation to create opportunities and raise sustainable economic growth.