市场研究机构iSuppli的最新预测报告指出,消费类电子终端设备市场与相关半导体市场,都将在2010年经历强劲的反弹成长;估计今年度消费电子设备销售额可达2,590亿美元,一扫该市场去年营收下跌幅度超过3%的阴霾。

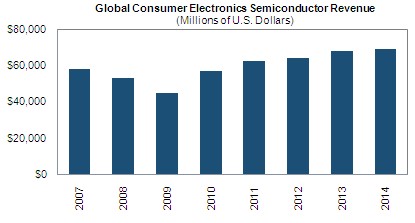

该机构并预期,消费电子设备市场营收将在接下来几年持续成长,估计2011年至2013年将陆续有6.7%、7%与1.2%的成长,但2014年将小幅衰退0.6%。至于消费性电子应用半导体市场营收,估计2010年规模可达572亿美元,较09年的448亿美元成长27.7%;该市场在09年衰退幅度达15.7%,但接下来也可望持续成长,并在2014年达到694亿美元规模。

“消费类电子营收的增长,目前的主要推力是来自高价值与高产量的液晶电视、蓝光光驱等设备;”iSuppli消费类平台首席分析师Jordan Selburn表示:“一件高价值消费类电子产品的芯片设计案,在整个产品生命周期中可赚到至少1亿美元的营收。”

然而Selburn也指出,开发高阶特殊应用芯片的成本持续上升,范围从1,000万美元到2,000万美元,为企业规模不大的二、三线芯片供货商带来压力,因为这些中小型企业恐怕无力负担高阶制程所需的费用。

2006~2011年半导体市场预测

点击进入参考原文:Consumer electronics rebounds, says iSuppli, by Peter Clarke

《电子工程专辑》网站版权所有,谢绝转载

{pagination}

Consumer electronics rebounds, says iSuppli

by Peter Clarke

The consumer electronics equipment and semiconductor markets are rebounding in 2010, according to analyst firm iSuppli Corp.

Revenue for the consumer electronics equipment market in 2010 is projected to reach $259.0 billion, all but erasing the decline of the previous year when revenue fell by more than 3 percent. The firm asserts that revenue will continue to rise in the coming years, increasing by 6.7 percent in 2011 and by 7 percent in 2012. Expansion will slow to 1.2 percent in 2013, after which the market is projected to contract by 0.6 percent in 2014.

Consumer-electronics-related semiconductor revenue will rise to 57.2billionin2010,up27.7percentfrom44.8 billion in 2009, states iSuppli. This represents a dramatic reversal from 2009, when revenue declined by 15.7 percent. Revenue will continue to rise during the coming years to reach $69.4 billion in 2014.

"The increase in consumer electronics revenue is currently fueled by high-value and high-volume products such as LCD-TVs and Blu-ray players," said Jordan Selburn, principal analyst for consumer platforms at iSuppli, in a statement. "A [IC] design win in a high-value consumer electronics product could make $100 million or more during the life of the device."

However, the cost of developing leading-edge application-specific chips continues to rise, ranging from 10millionto20 million, Selburn said. This puts pressure on smaller second- and third-tier companies that may not be able to afford leading-edge manufacturing.