市场研究机构iSuppli的最新报告指出,合约制造商正面临供需不平衡的挑战,目前的状况是零组件库存吃紧,原料却生产过剩,而零件的缺货问题已经在全球电子供应链造成“连环车祸”般的灾难。

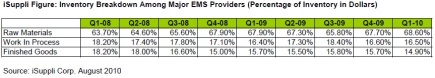

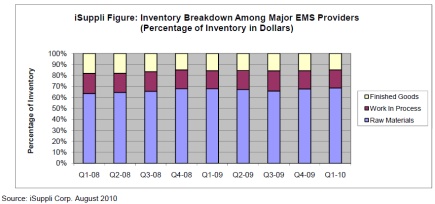

iSuppli指出,观察全球前五大电子制造服务(EMS)的最新库存状况显示,在2010年第一季,零组件与原材料占据近七成的总库存量;相对来看,在制品(work-in-process goods)占据总库存量的比例为17%,成品(finished goods)所占比例则低于15%。

该机构EMS/ODM市场分析师Thomas Dinges表示,成品库存自2008年第四季以来就处于最低水平,而这样的不平衡状态可能会持续下去:“iSuppli认为,目前原料占据大部分电子供应链库存比例的趋势将持续好一阵子,这意味着有更多的成套产品正等着被完成。”

点击进入第二页:许多半导体分立组件的交货期情形甚至更糟...

{pagination}

Dinges指出,根据厂商的财报与业界消息判断,半导体供货商都指称产品交货期(lead times)延长与零件缺货是目前所面临的主要问题。iSuppli则发现,许多半导体分立组件的交货期情形甚至更糟,目前甚至拉长到去年同期间的一倍。

iSuppli表示,以连接器产品为例,在7月份时最短的交货期是10周,在2009年7月则是5周;整流器、小型讯号分立组件等产品的交货期最长,现在已经来到20周左右,在去年同期则是10周。

根据Dinges说法,许多供应链中的厂商都不认为以上状况能在今年之内改善,甚至近期出现需求趋缓迹象也于事无补。而困难之处在于季节性因素的结合,以及厂商在增加产能方面的进度缓慢。

“有许多供货商在去年都因为金融风暴而停工,产能的短缺也导致了产业的供应瓶颈;”Dinges表示:“如此的零组件与材料短缺,只会为EMS与ODM厂添加压力,就算他们只是单纯想维持现有的库存流通率(inventory velocity)水平。”

点击进入参考原文:Report: EMS vendors face supply chain 'pileup'

《电子工程专辑》网站版权所有,谢绝转载

{pagination}

Contract manufacturers are facing a challenging supply imbalance characterized by tight inventories of components and a glut of raw materials as part shortages have created a "traffic pileup" in the global electronics supply chain, according to a report by market research firm iSuppli Corp.

A snapshot of inventory at five of the larger electronic manufacturing service (EMS) providers showed that components and raw materials accounted for nearly 70 percent of total inventories during the first quarter of 2010, the latest date for which quarterly data is available, iSuppli (El Segundo, Calif.) said. In comparison, work-in-process goods made up about 17 percent of inventories, while finished goods comprised less than 15 percent, according to the firm's analysis.

Finished goods were at their lowest level since the fourth quarter of 2008—and the imbalance is likely to persist, according to Thomas Dinges, iSuppli EMS and ODM analyst.

"ISuppli believes that the current trend—in which electronics inventories are being weighed down by an overwhelmingly large percentage of raw materials—will continue for some time to come, given that more product in kits are waiting to be finished," Dinges said, in a statement.

Judging from various earnings calls as well as numerous conversations taking place in the industry,

semiconductor companies are citing extended lead times and parts shortages as a major problem, Dinges said.

Limes have worsened for a wide range of semiconductor discrete devices, running as much as 100 percent longer than for the same period last year, according to iSuppli. The shortest lead times—at 10 weeks as of July—are for connectors, up from five weeks in July 2009, the firm said. The longest lead times are for rectifiers and small signal discretes, now running at 20 weeks—a full five months compared to 10 weeks last year at this time, iSuppli said.

Dinges said that many supply chain industry contacts to whom iSuppli has spoken do not believe the situation is likely to improve until later in the year—even if demand softens in the near term. The difficulties, he said, arise from a combination of seasonality factors and the slow pace in bringing about increased production capacity.

"Given that many suppliers were shuttered during the last years because of financial distress, the shortages have resulted in supply bottlenecks in industries," Dinges said. "Such shortages—in both parts and raw materials—will only add to the strain of EMS and ODM providers, even if they were to train their efforts at simply maintaining current levels of inventory velocity."

ISuppli is offering Dinges' new report on EMS and ODM inventory for sale through its website.